Covenants

Know before you breach

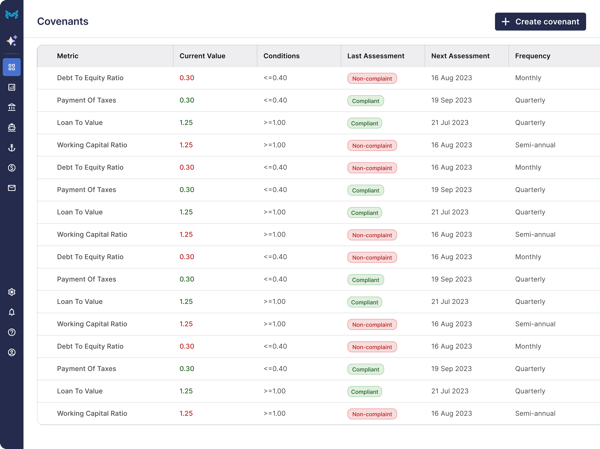

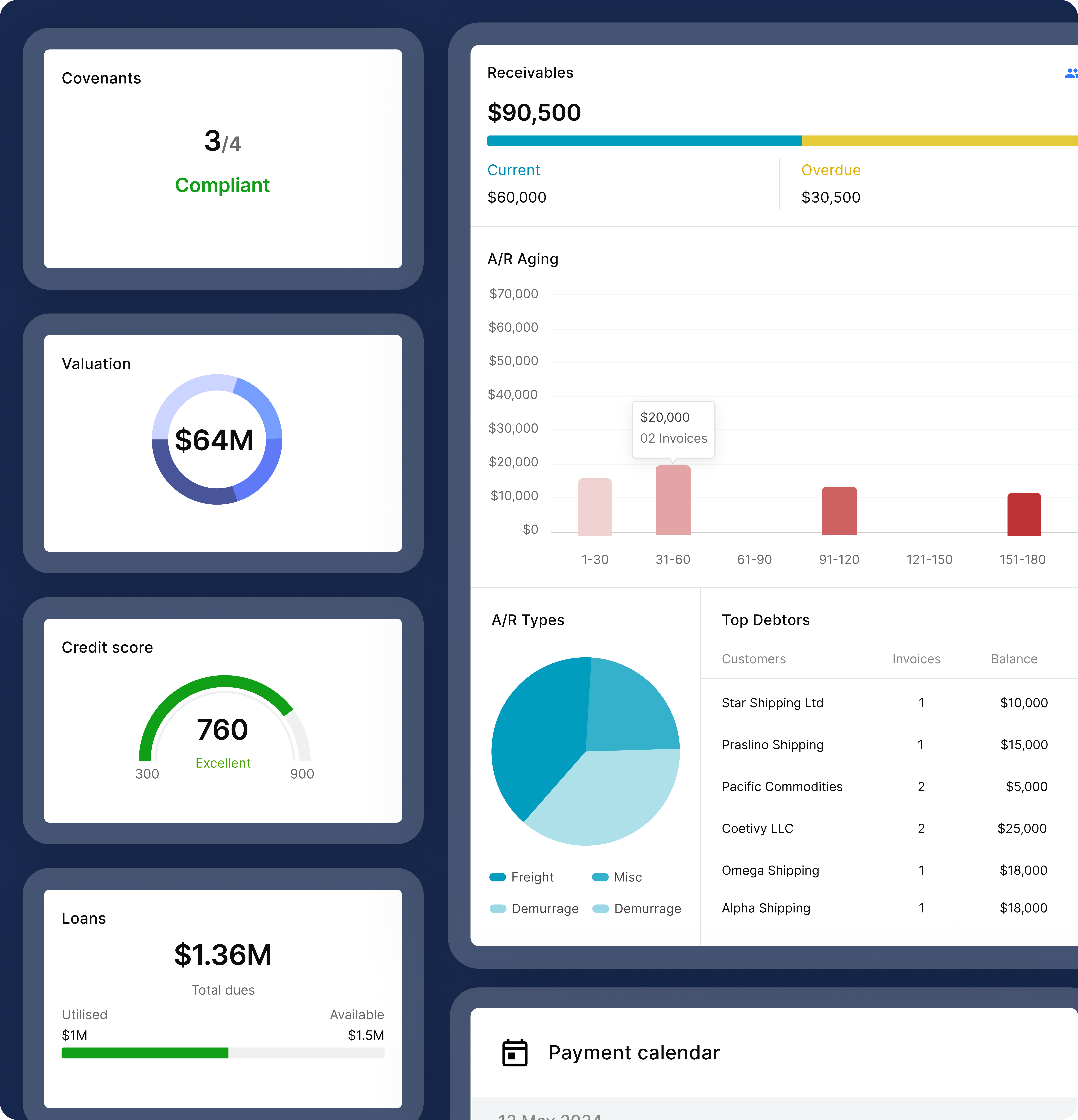

Track critical covenants like Debt-to-Equity and Loan-to-Value in real time. Stay compliant, avoid surprises, and maintain trust with your financiers.

Risk Management

Breaches don’t warn you. We do.

Get instant alerts when covenants near critical limits.

Manage risks proactively

Fix issues before they affect your credit lines.

Improve decision-making

Adjust voyage plans and DA forecasting with live data.

Tailored Tracking

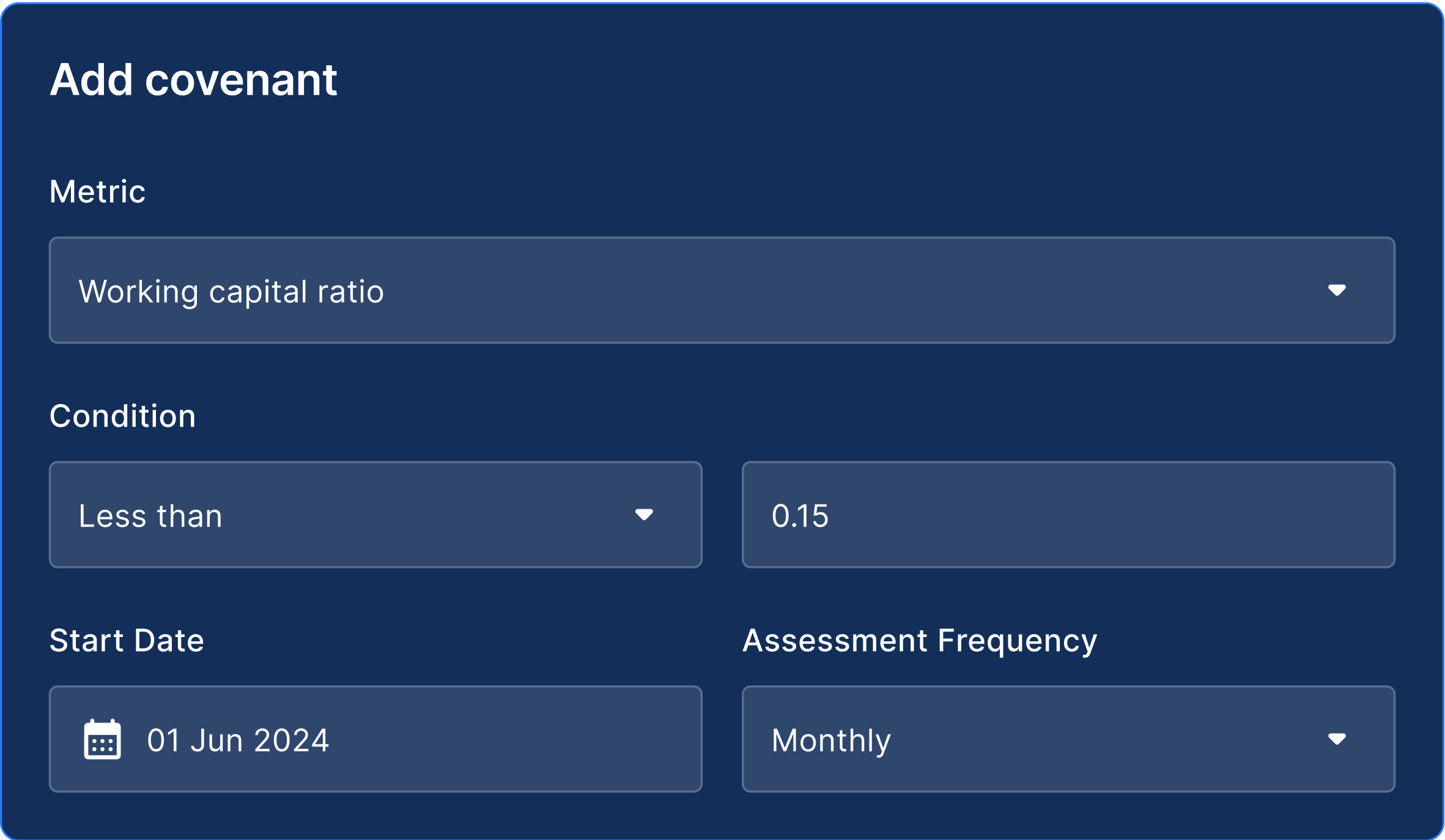

Build the covenant tracker that works for you

Add custom covenants, define ratios, and track the exact financial signals your maritime lenders require.

Alignment with your business

Focus on what banks monitor—Debt Service, LTV, liquidity ratios.

Scalability and flexibility

Adapt the setup as your charter terms and exposure change.

Financial Accuracy

Fix errors before they cost you

Validate covenant inputs and update wrong entries before reports go out.

Enhanced financial integrity

Flag unusual changes in key ratios like DSCR and leverage.

Time and cost efficient

Avoid rework, reduce compliance questions from lenders.

Take control of your loan compliance, not just your cash

Set covenant rules, track violations, and correct mistakes—all in one tool built for the realities of maritime finance.

Why Marlo?

How to stay compliant without slowing down operations

Track covenants, adjust ratios, and review reports without stopping vessel activity.

Proactive financial control

Get alerts when metrics approach breach levels—act before it’s too late.

Customizable financial framework

Track custom metrics that reflect your financing terms, not just generic ratios.

Reliable financial accuracy

Reduce reporting errors that can damage lender trust or delay future funding.

Your fleet deserves smarter software

Let us show you how Marlo can simplify your operations, save you money, and help you grow.

Sign up

KYC

Frequently Asked Questions

-

How does Marlo help me manage my loan covenant compliance?

Marlo lets you input and track key loan covenants in one place, so you never miss a reporting deadline or breach due to oversight.

-

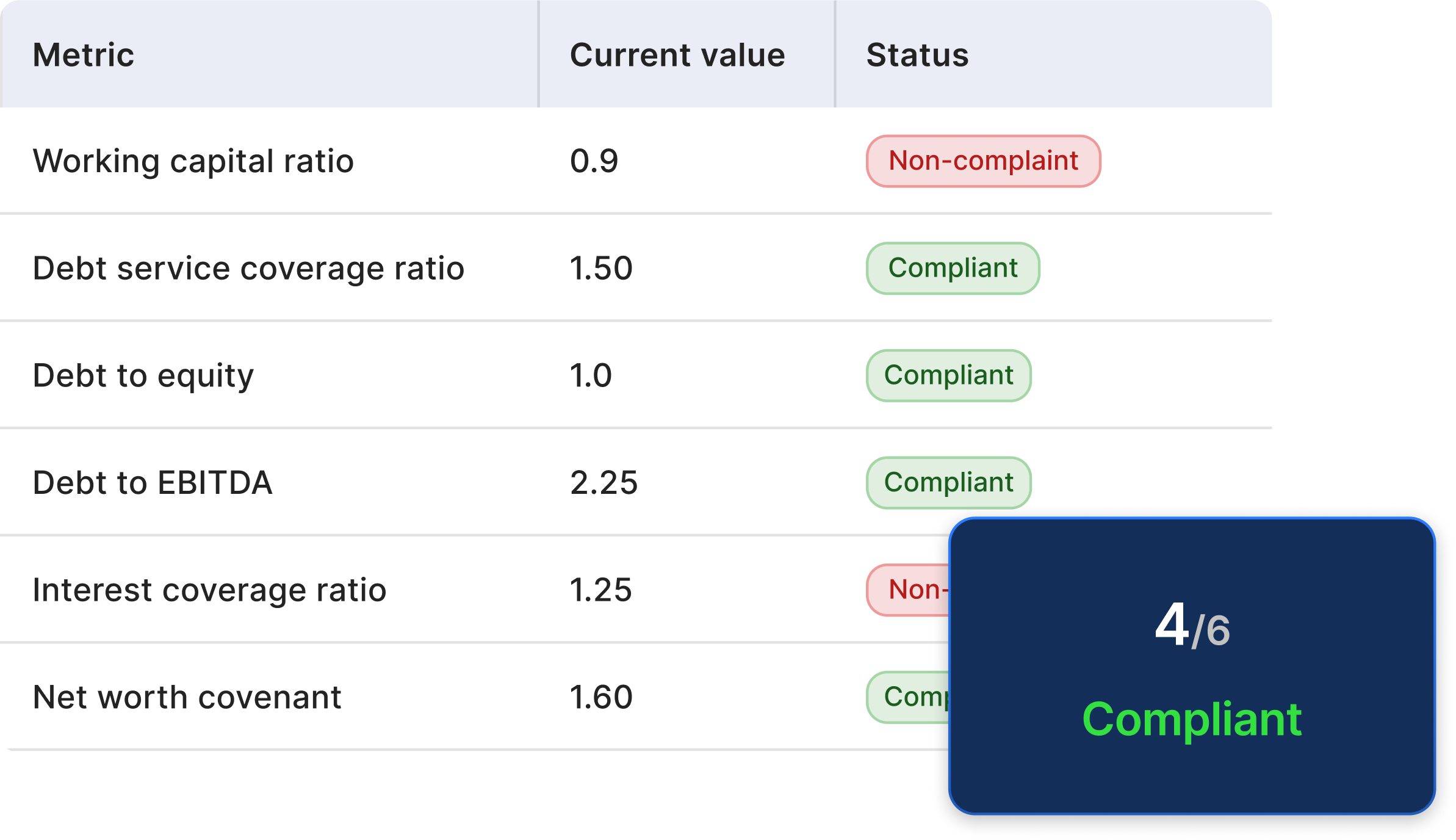

Which financial covenants can I track using Marlo?

Marlo supports tracking six core covenants: working capital ratio, DSCR, debt-to-equity, debt-to-EBITDA, interest coverage, and net worth.

-

Can Marlo remind me of upcoming covenant deadlines?

Yes, Marlo sends timely notifications ahead of each reporting deadline, helping you stay on top of lender requirements with ease.

-

What kind of alerts does Marlo provide for covenant risks?

Marlo notifies you if your inputs suggest potential non-compliance, giving you time to address issues before reporting.

-

Do I need to manually enter financial data into Marlo for covenant tracking?

Yes, financial data is manually entered into Marlo, ensuring accurate covenant tracking based on your latest figures.