Credit Score

What’s your credit score costing you?

Get a clear view of your business’s credit score—and find out what’s helping or hurting your financial standing.

Credit Score Overview

How to read your credit like a lender?

See what lenders see—payment history, risk level, debt signals—so you can prepare before they judge.

Clear Credit Status

Know Where You Stand Before They Decide.

Actionable Recommendations

Fix the Gaps Holding You Back.

Up-to-Date Financial Insights

Your score changes every day—don’t miss it

Your credit shifts with every transaction. Marlo tracks it daily so you’re never caught off guard.

Timely Updates

Spot Trouble Early—Act Fast.

Responsive Management

Stay in Control When Conditions Change.

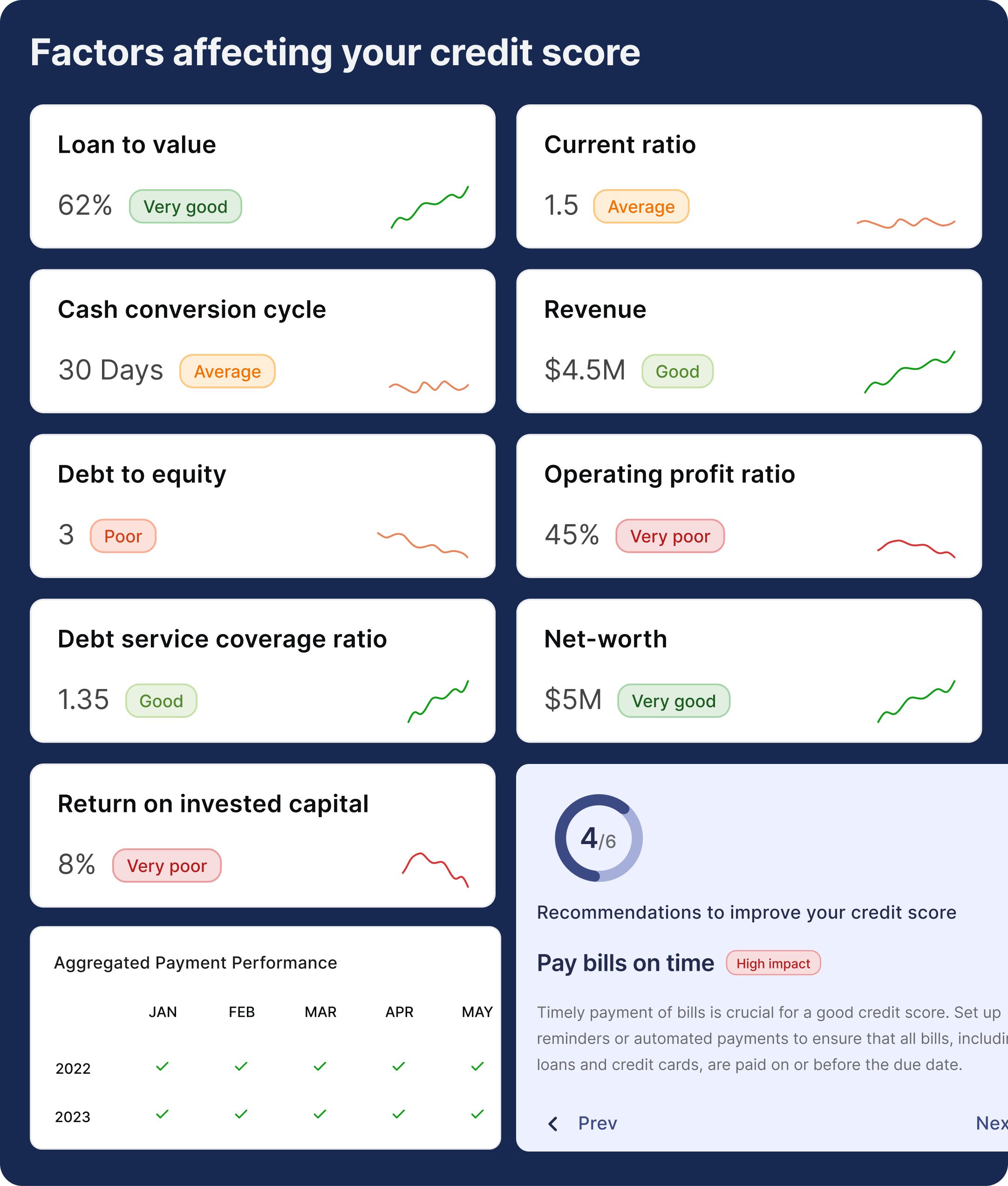

Understanding Credit Factors

What your risk rating really means?

Credit risk isn't a number—it’s how lenders see your future. Marlo breaks it down in plain terms.

Risk Clarity

Translate Risk Ratings into Real-World Impact.

Future Planning

Plan Ahead—Before Risk Blocks a Loan or Deal.

Why Marlo?

Your financial blind spots—revealed.

You can’t fix what you can’t see. Marlo shows how credit risk, payment timing, and debt ratios affect your position.

In-Depth Analysis

Break Down What’s Holding You Back.

Agile Response

Adjust Fast—Before Risk Turns Into Rejection.

Clear Risk Understanding

Know the Hidden Risks That Block Growth.

Your fleet deserves smarter software

Let us show you how Marlo can simplify your operations, save you money, and help you grow.

Sign up

KYC

Frequently Asked Questions

-

What is Marlo’s credit score and how is it calculated?

Marlo’s credit score is a real-time financial rating based on your cash flow, repayment history, and transaction patterns. It updates automatically from your latest financial data.

-

How does Marlo’s credit score help improve my business funding options?

A strong Marlo score increases your chances of better loan terms, quicker approvals, and stronger credibility with lenders and partners.

-

How often does my Marlo credit score update?

It updates continuously as new financial data flows in—no manual action needed.

-

Who can see my Marlo credit score?

Your score is private and only visible to you and approved financing partners within the Marlo platform.

-

What factors can lower my Marlo credit score?

Irregular cash flow, late payments, and high outstanding balances can reduce your score.