Maritime Finance

Keep your fleet moving—without financial delays

Secure the funds you need to cover voyage costs, avoid delays, and keep operations on course.

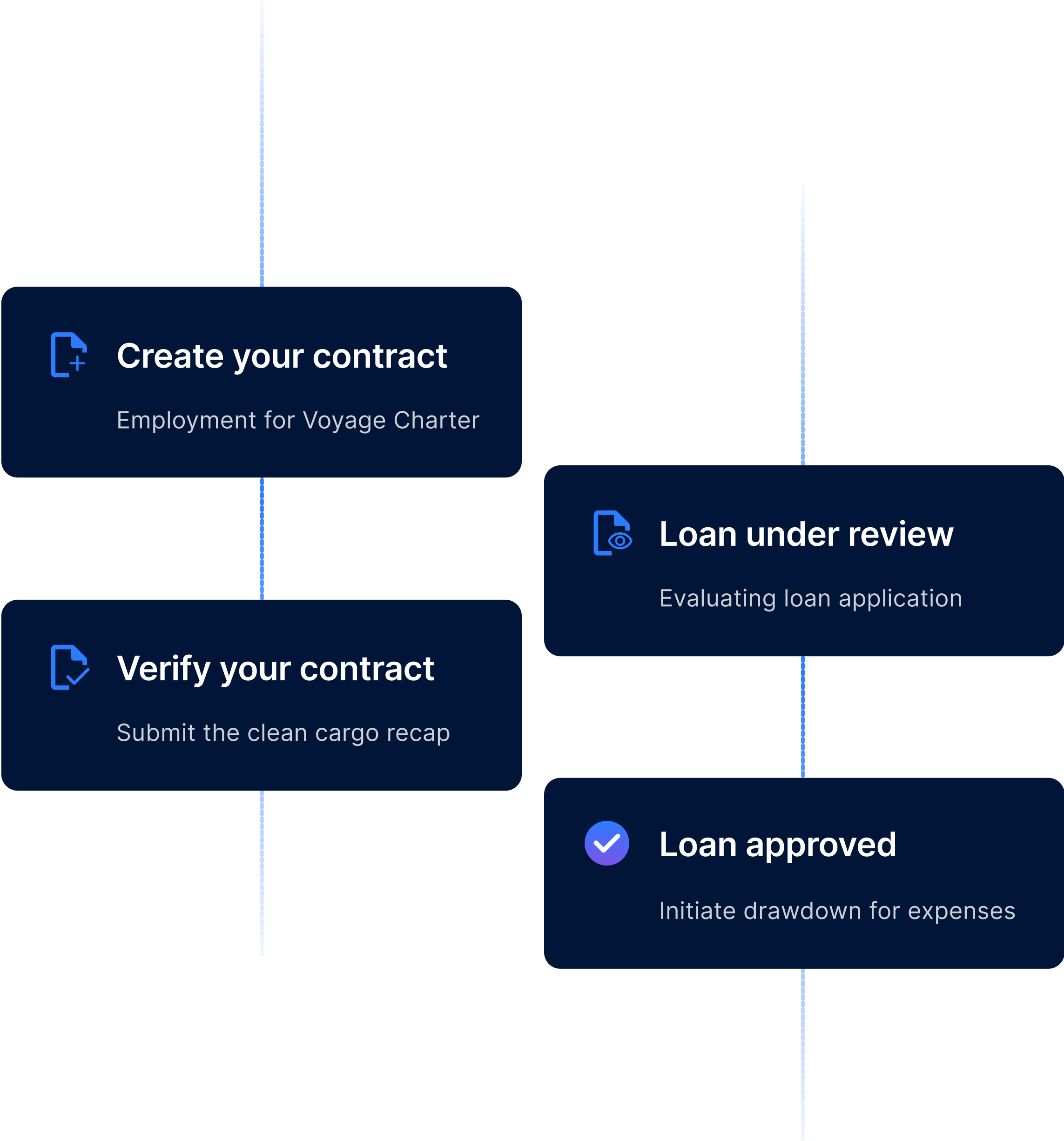

Instant loan application

Apply today. Get funded without the paper trail.

Marlo’s application process is online, simple, and built for maritime needs—no paperwork or surprise costs.

Quick and convenience

Speed that keeps cargo flowing — avoid operational standstills.

Transparent and secure

Clear terms, no surprises — your costs are always known upfront.

Flexible financing

Finance built around your voyage cycle

Choose loan options that match your shipment schedules and port activity, so your cash flow stays predictable.

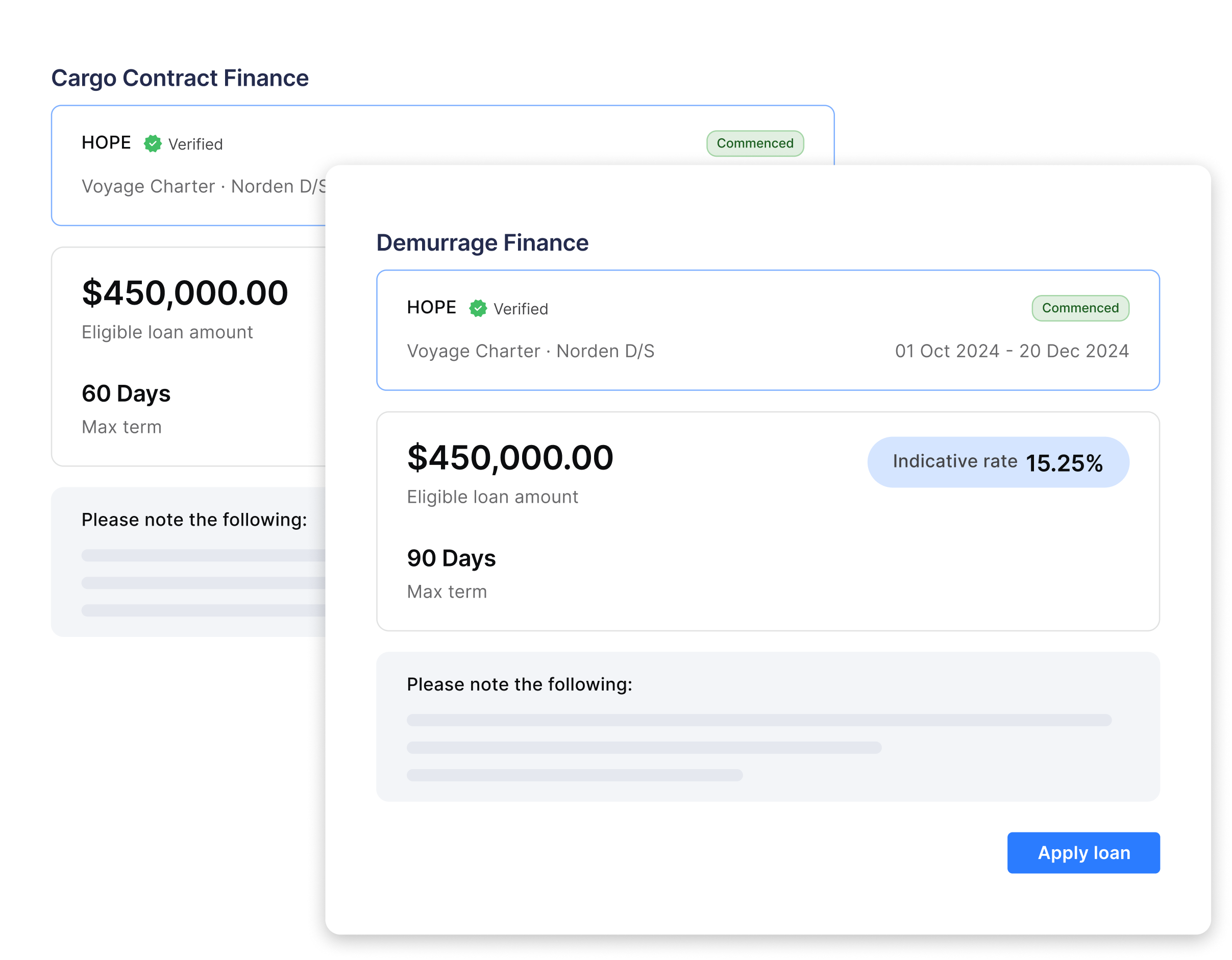

Cargo Contract Finance

Finance that tracks with your shipment — no more cash gaps during loading or transit.

Demurrage Finance

Get funding to cover demurrage so port delays don’t hit your margins.

Streamlined solutions

Loans built for maritime business demands

Whether you're financing cargo or covering unexpected costs, our loans are designed for your realities at sea and at port.

Tailored for maritime needs

Built for maritime—every loan fits the timing, costs, and unpredictability of your trade.

Quick and flexible financing

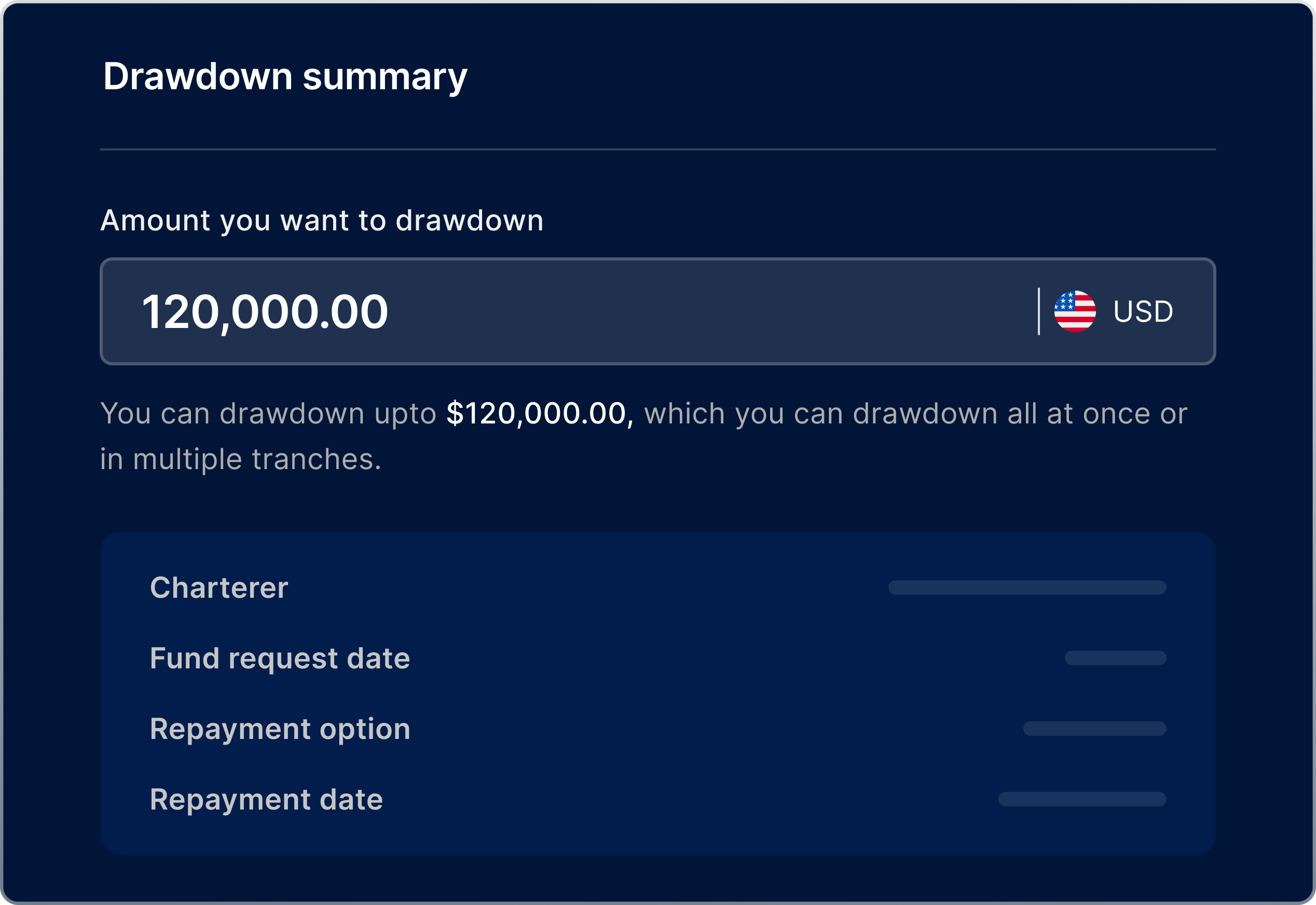

Approvals and drawdowns designed around your contract cycles.

Instant drawdown

Draw funds into your account when you need them—no delays, no detours.

Solve the daily money challenges of running a vessel

Cover costs like bunker fuel and port dues without halting operations or delaying cargo.

Custom financing solutions

From vessel repairs to bunker bills, we help you fund what matters most today.

Control your team’s spend and permissions

Set who can spend, and where — avoid cost overruns and stay on budget.

Get the funds you need—before your next port call

Your fleet deserves smarter software

Let us show you how Marlo can simplify your operations, save you money, and help you grow.

Sign up

KYC

Frequently Asked Questions

-

What types of loans does Marlo offer for maritime businesses?

Marlo offers Cargo Contract Finance and Demurrage Finance—built to cover shipment costs, working capital gaps, and port delays.

-

How quickly can I apply and receive funds?

Apply online in minutes—no paperwork. Funds are released fast once approved, so voyages stay on track.

-

What makes Marlo’s financing tailored for shipping companies?

Marlo links financing to your voyage cycle—covering bunkers, port dues, and transit delays—ensuring cash flow aligns with shipping timelines.

-

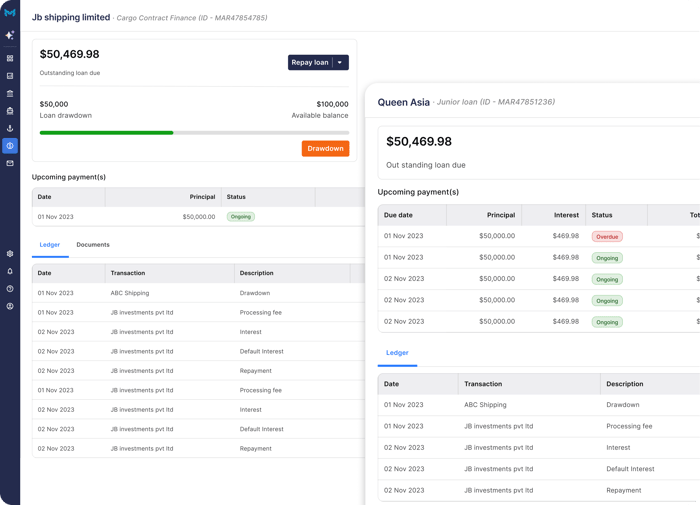

Can I use Marlo to monitor repayment status for each loan?

Yes. Each loan comes with real-time tracking for repayment dates, amounts, and outstanding dues across all vessels.

-

How does Marlo help reduce loan-related risks?

Marlo gives visibility into loan structures and repayment health, helping you avoid defaults, manage exposure, and plan better across fleets.