Borderless Cards

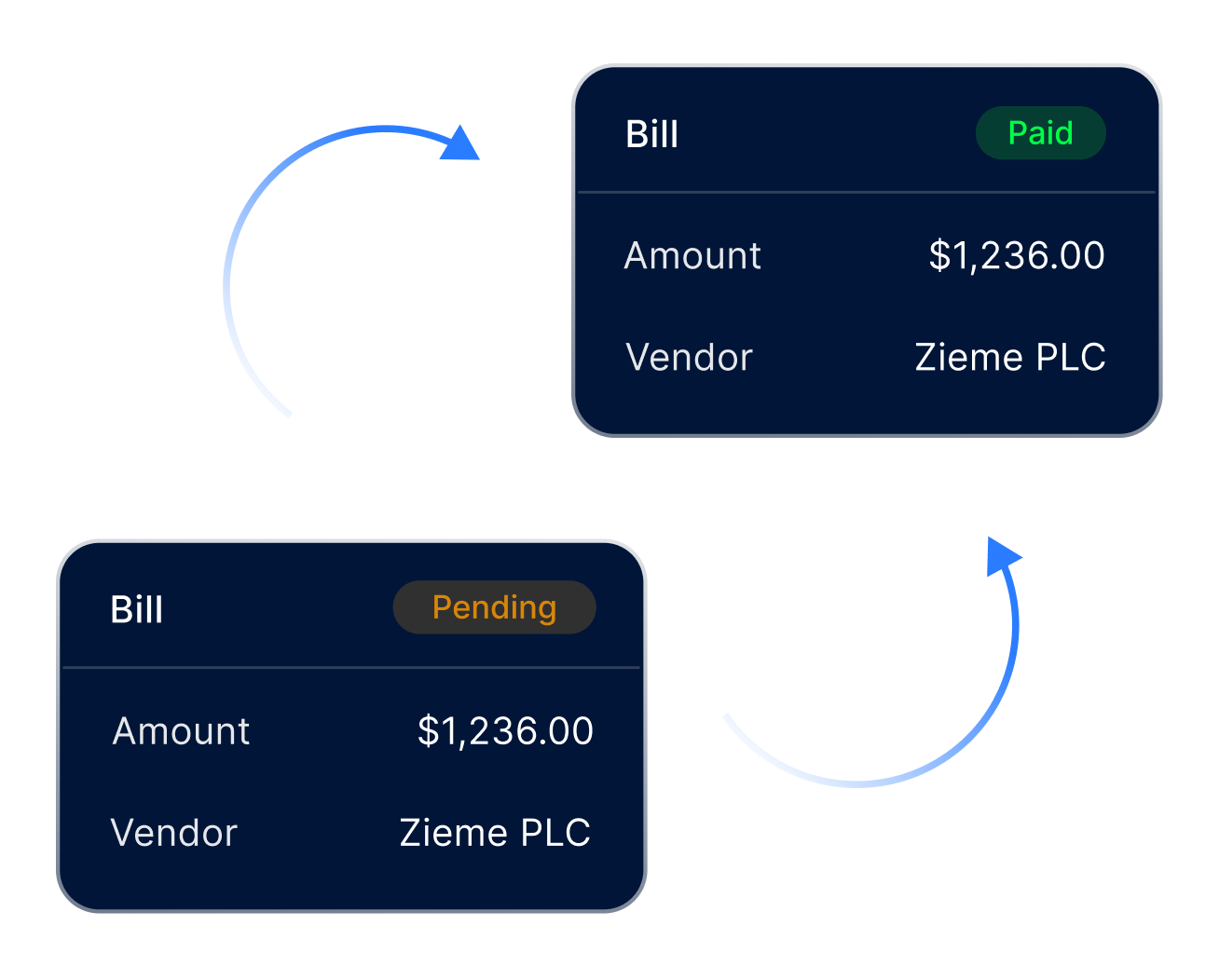

Cut overspending before it starts

Give your team the freedom to spend — with limits you control and costs you can predict.

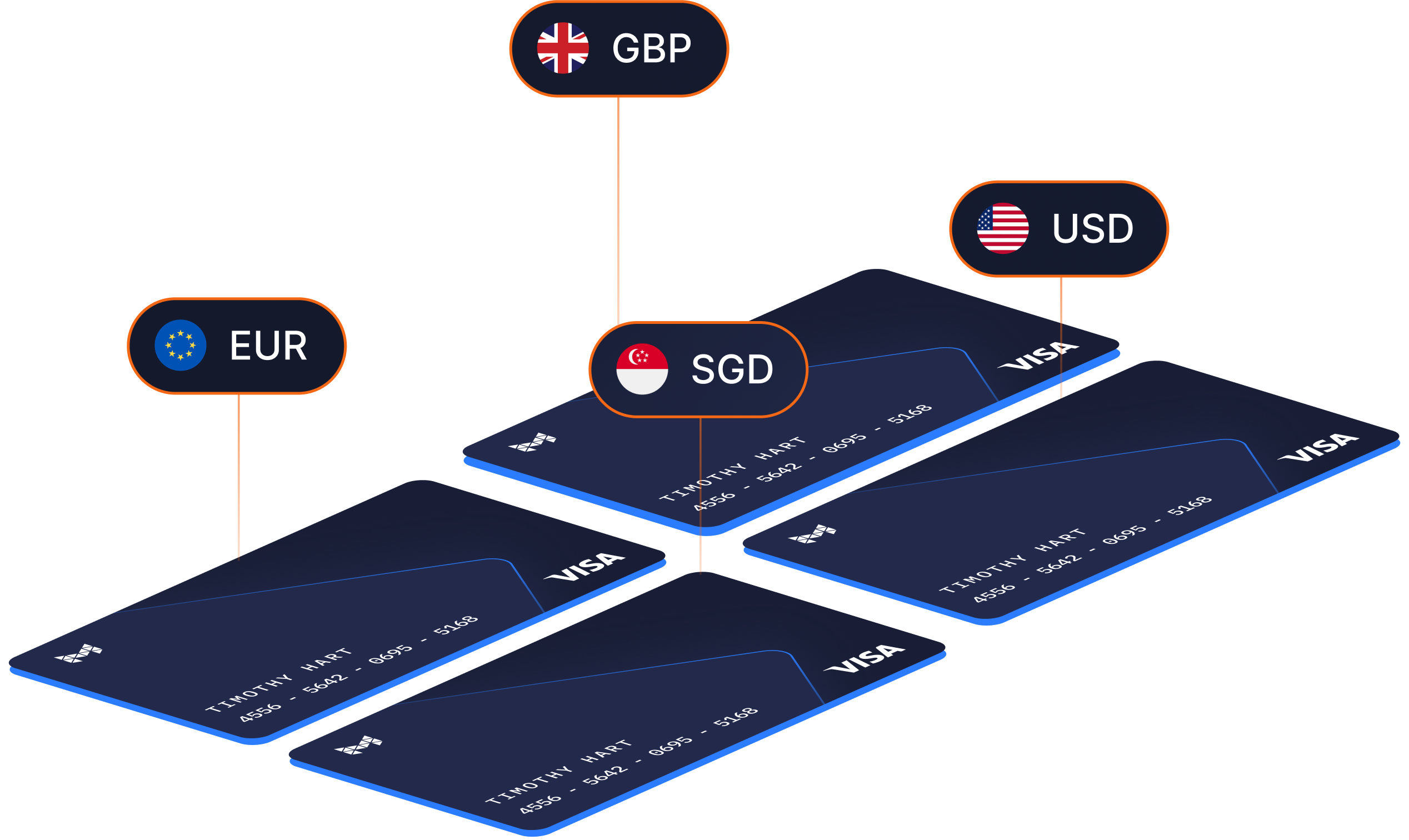

Marlo Business Cards

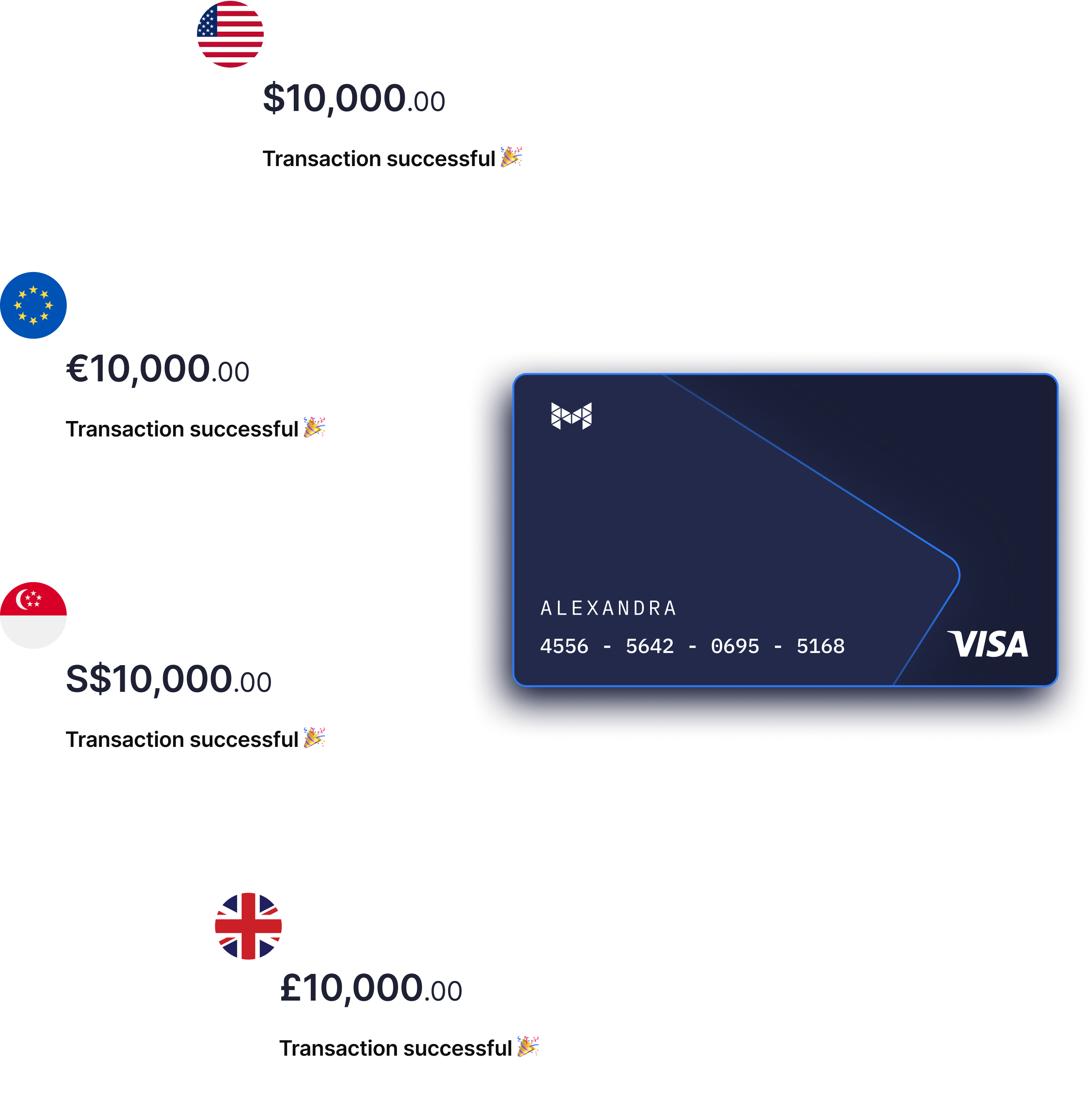

Spend globally without surprise charges

Use cards that work in any currency — with no hidden fees and real-time spend tracking.

Global transactions made easy

Buy worldwide without guessing exchange rates.

Track spending instantly

See every transaction as it happens.

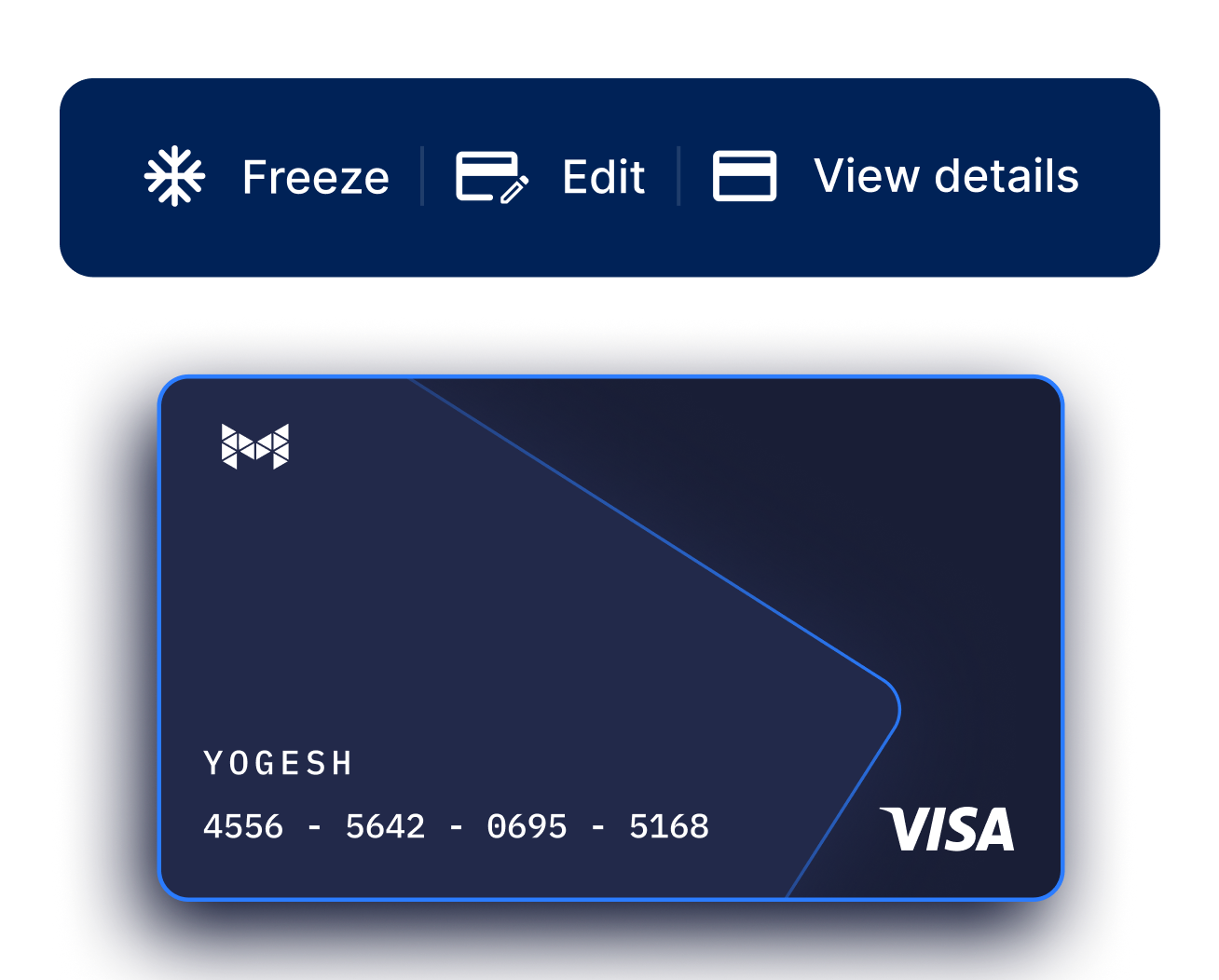

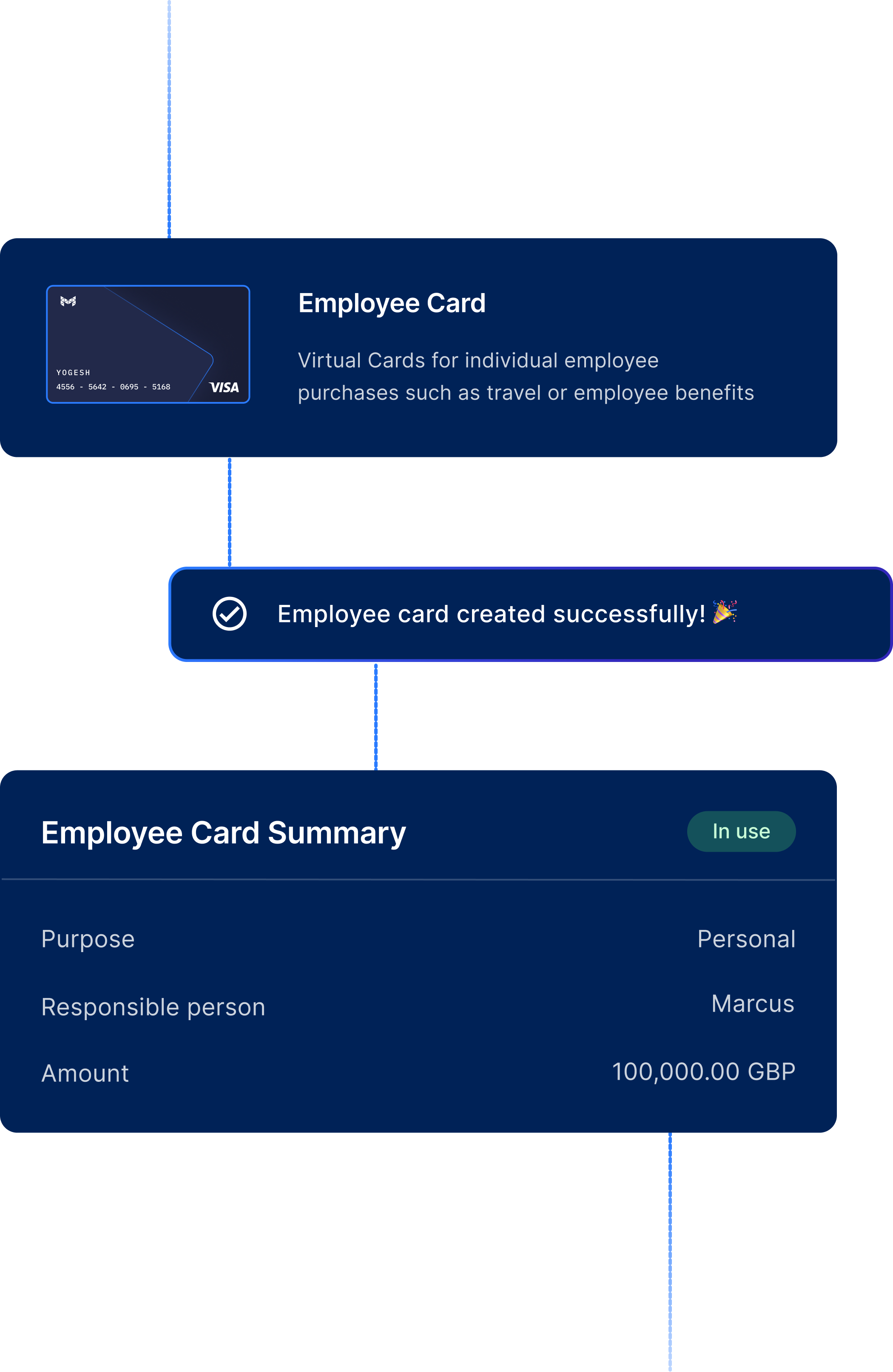

Employee Cards

Set limits. Let your team buy what they need.

Approve spending before it happens. Let your team handle purchases without losing control.

Control spending limits

Lock in team budgets.

Empower your team

Free your team to buy what moves the work forward.

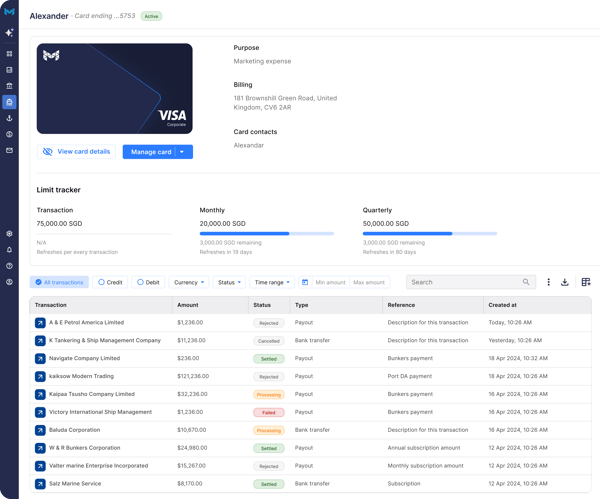

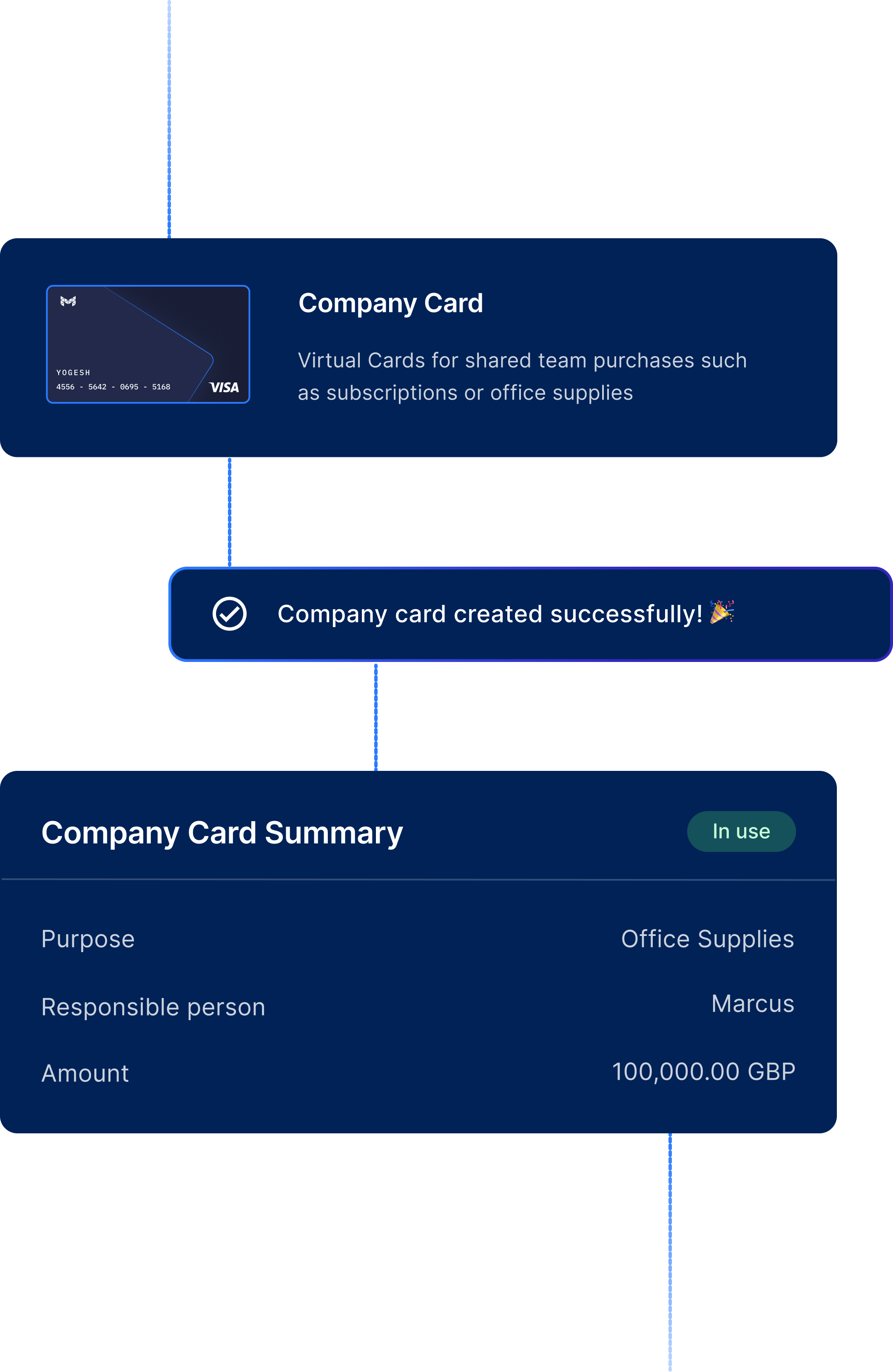

Company Cards

Too many expense reports? Fix that.

Assign cards to teams or budgets and track every spend in one view.

Centralize expense tracking

Get all card activity in one place.

Minimize spending risks

Set hard limits to avoid going over budget.

Share a card across the team

Let departments share one card — without losing control.

How to issue cards without the paperwork

Create cards for any use or team in seconds. Control who spends what — and where.

Efficient global transfers

Send money across borders with account details built for global transfers.

Control team spending and permissions

Set limits and permissions for every user.

Stop worrying about card misuse

Freeze cards instantly, set permissions, and move money with peace of mind.

Why Marlo?

Cut costs on every international purchase

Avoid foreign transaction fees and pay directly in the currencies you hold.

Issue cards to your global team

Equip teams to spend abroad without conversion loss.

Direct payments from balances

Pay vendors using your account balance.

No foreign transaction fees

Skip hidden fees at checkout.

Automatic currency conversion

Convert currencies only when needed.

Your fleet deserves smarter software

Let us show you how Marlo can simplify your operations, save you money, and help you grow.

Frequently Asked Questions

-

What is a Marlo corporate card and how does it support maritime teams?

A Marlo corporate card is built for maritime businesses—use it globally, with no hidden fees and full control over international spending.

-

How can I control team spending with Marlo cards?

Set spending limits, freeze cards anytime, and require approvals—manage team expenses in real time.

-

How to set up your employee with a Marlo card?

Yes—create and control cards instantly without paperwork.

-

How does Marlo handle FX and fees on global spends?

Marlo auto-converts currencies at real-time rates, with zero foreign transaction fees.

-

Can Marlo cards replace expense reports and simplify tracking?

Yes—Marlo centralizes all card activity, cutting manual reports and improving oversight.