FX & Transfer

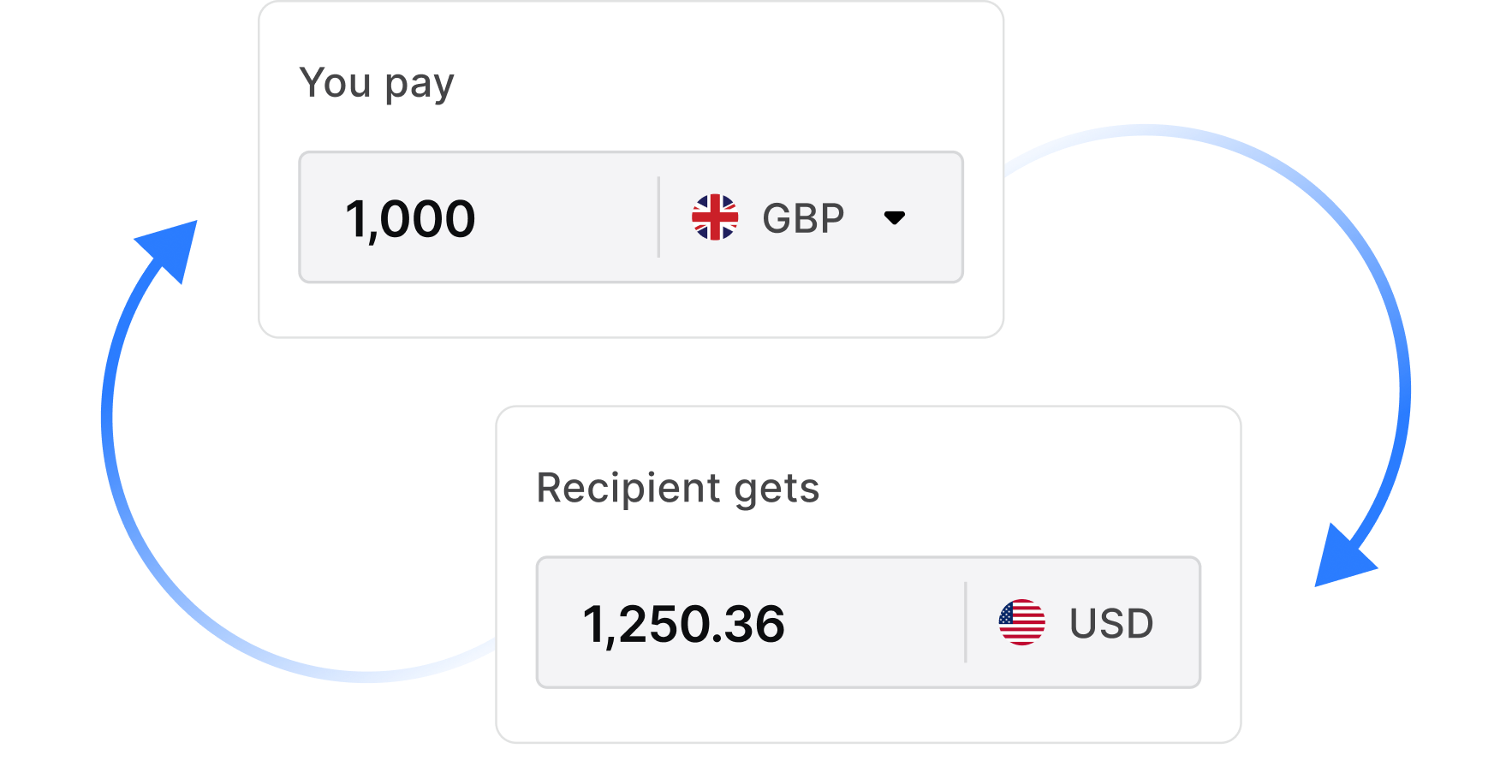

Cut international payment costs. Keep more of what you earn

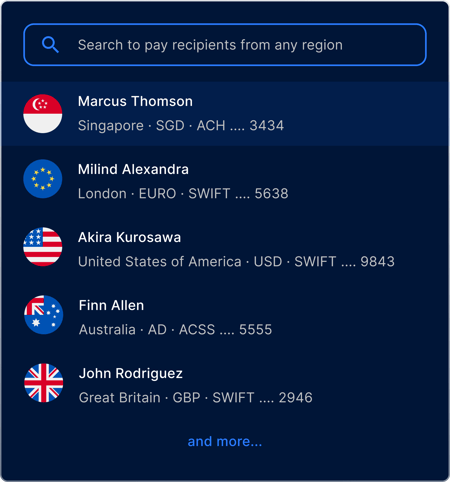

Send money globally with bank-beating FX rates—no matter the amount. One platform for all your cross-border payments.

%20-%20(L1).png?width=650&height=450&name=Payables%20(Bill%20payments)%20-%20(L1).png)

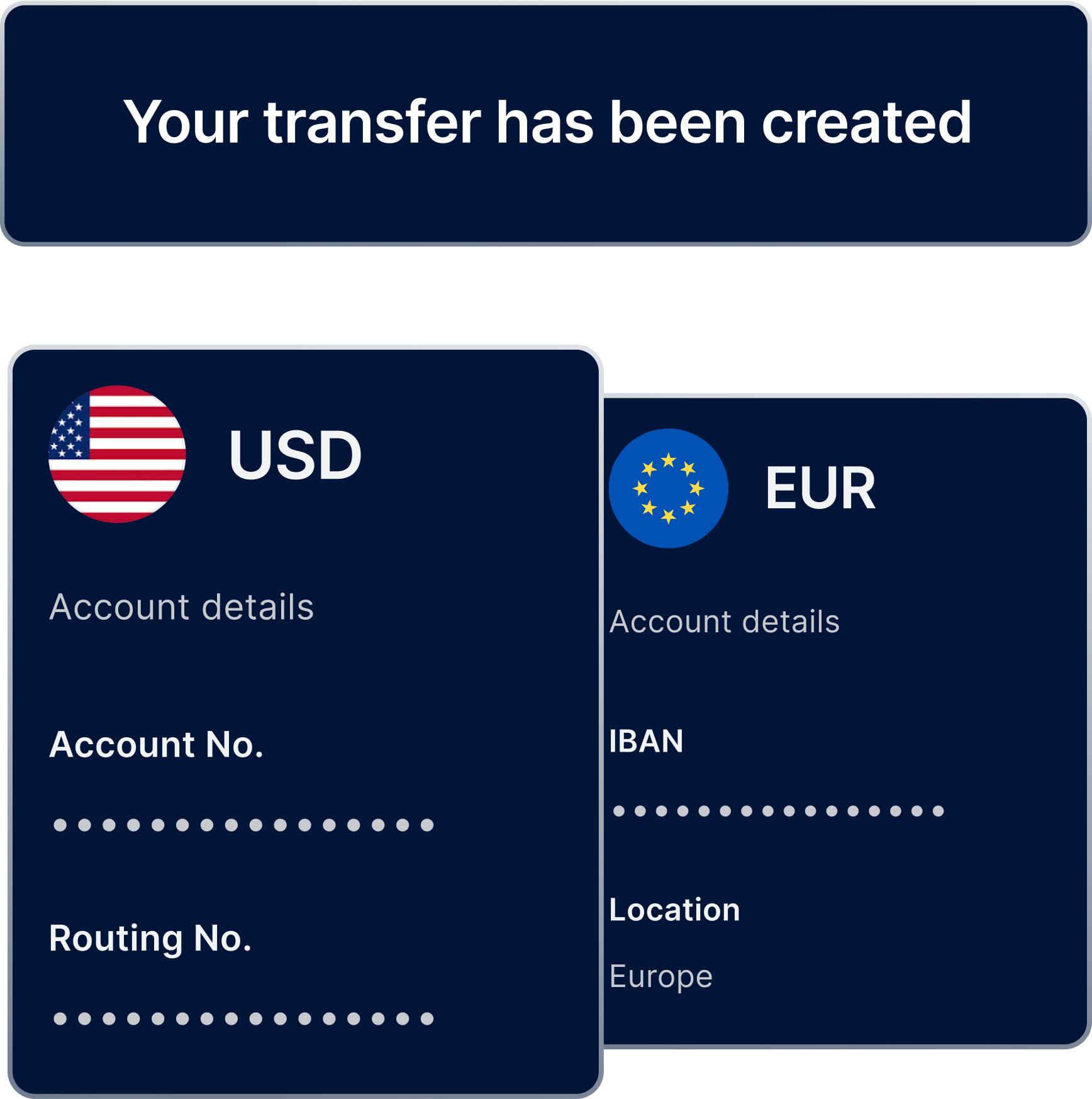

Global Transfers

40+ currencies. No hidden fees.

Receive, hold, and convert over 40 currencies. Transparent rates, no surprise charges.

Multi-currency management

Manage 40+ currencies in one place—no need for extra accounts.

Flexible account setup

Open as many currency accounts as you need—at no extra cost.

Hassle-free Payments

Stop losing on transfers. Send money anywhere at better rates.

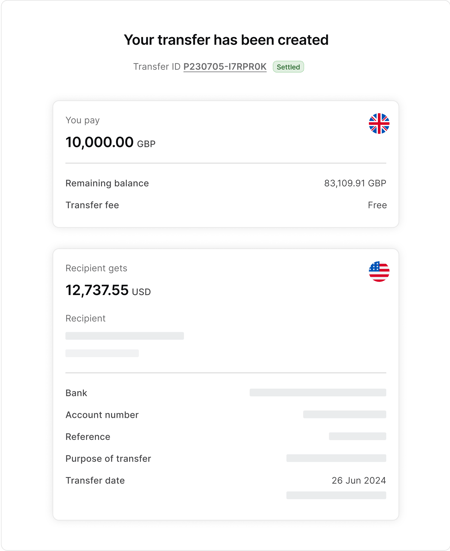

Send and receive funds locally or globally with low fees and live tracking..

Cost-Effective Transfers

Cut transfer fees on local and international payments.

Real-Time Transfer Tracking

Track every payment step with live status updates.

Approval Workflows

Team controls that match your workflow

Assign clear roles and permissions to team members—so every task is in the right hands.

Customizable workflows

Grant permissions by role—control who can view, send, or approve transactions.

Detailed user permissions

Define exact access for each user—view only, send, or approve.

Strong security measures

Built-in user roles and permissions for secure team access.

Send more. Pay less. Transfer across borders without bank fees.

Transfer globally at up to 3x lower fees than banks. Use one account to send, receive, and hold money.

Global convenience

Send international payments as easily as domestic ones—no paperwork.

Top FX rates

Send money to 140+ countries at market FX rates. No hidden charges.

Why Marlo?

How to pay suppliers in 150+ countries—without extra bank fees

Pay suppliers and teams abroad—without long waits or inflated fees.

Wide reach and fast payments

Send and receive in 150+ countries and 40+ currencies—most payments complete in 1 day.

Enhanced security

Built-in team access ensures only the right people handle payments.

Simplified bookkeeping

Auto-sync payments with your accounting software—no manual data entry.

Your fleet deserves smarter software

Let us show you how Marlo can simplify your operations, save you money, and help you grow.

Frequently Asked Questions

-

How fast are international financial transfers processed through Marlo?

Marlo processes most international transfers within 1–3 business days, with real-time tracking for full visibility into your financial transactions.

-

What financial information can I track when sending FX payments with Marlo?

You can view details like payment amount, currency exchanged, FX rate applied, and transfer status for every transaction you initiate.

-

Does Marlo charge fees for cross-border payments or FX transfers?

Marlo offers transparent FX pricing with no hidden charges, helping you reduce global payment costs by up to 3× compared to banks.

-

Can I manage multi-currency financial data in Marlo?

Yes, Marlo lets you receive, hold, exchange, and monitor balances across currencies—all from one account, without opening separate bank accounts.

-

How does Marlo secure my financial and operational data during transfers?

Marlo uses bank-grade encryption and multi-factor authentication (MFA) to keep all your financial data and transaction history safe.