Valuations

Know your fleet’s worth—instantly

Access daily valuations of your vessels and fleets to make informed financial decisions without delays.

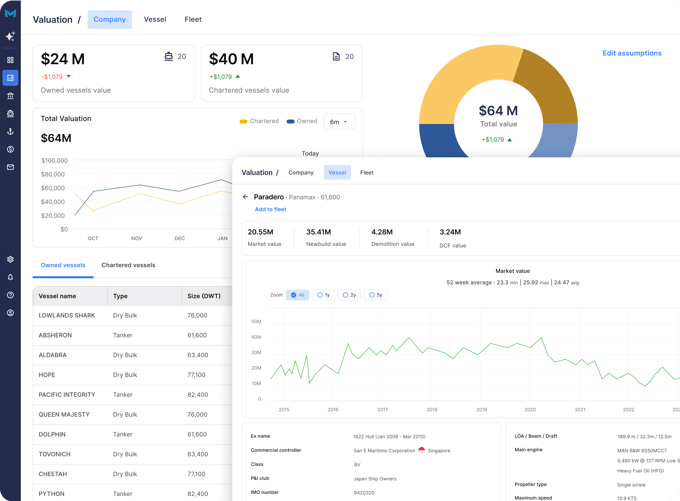

COMPANY VALUATION

Monitor your entire fleet’s value daily

Keep tabs on the current value of all owned and chartered vessels with daily updates.

Real-Time Portfolio Tracking

View up-to-date valuations for every vessel in your fleet.

Comprehensive Asset Overview

Understand your company's total maritime asset value at a glance.

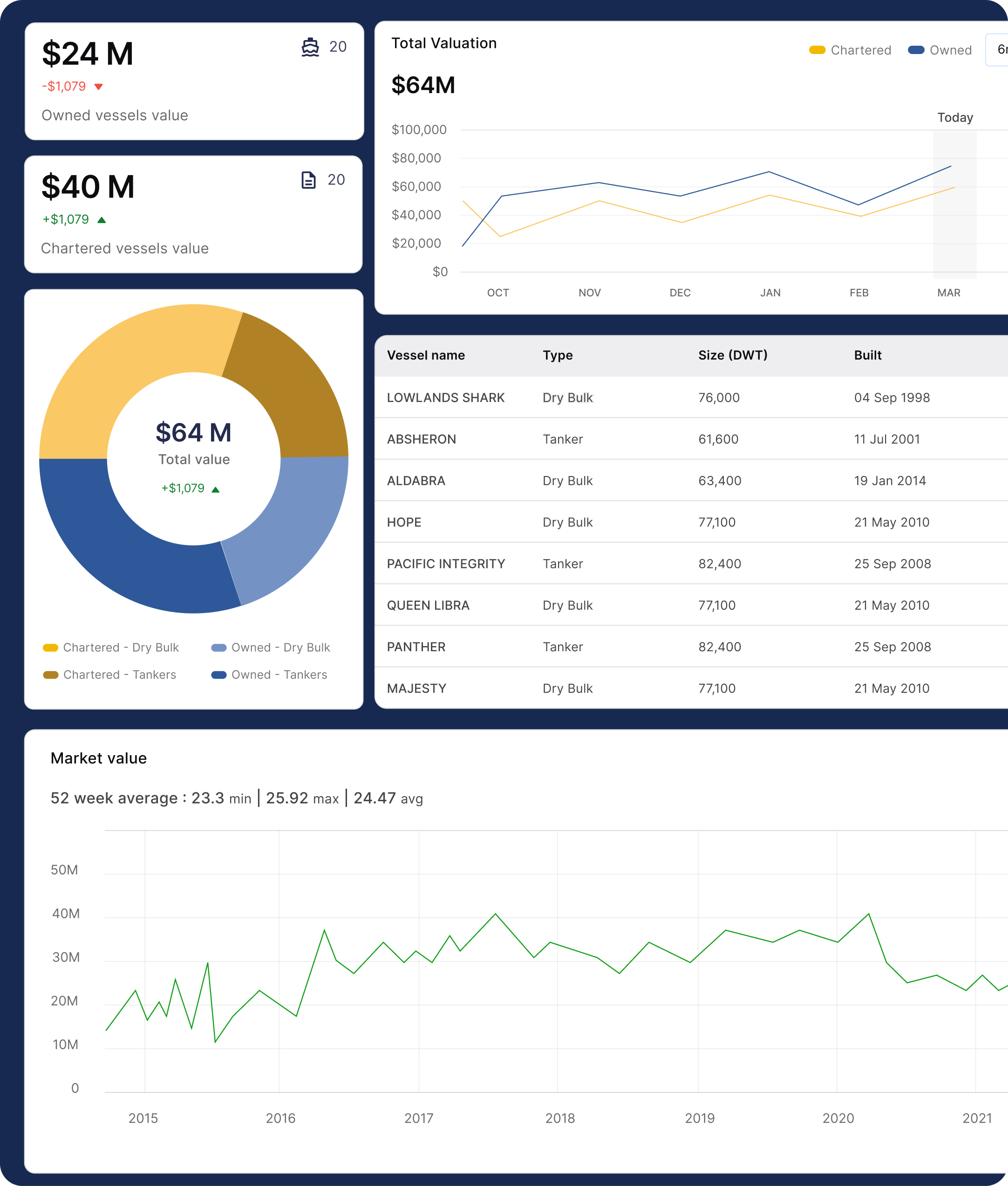

VESSEL VALUATION

Evaluate individual vessel worth accurately

Search any vessel to access its current market value, estimated new build cost, and projected end-of-life value.

Detailed Valuation Data

Gain insights into market trends and future projections for each vessel.

Data-Driven Decisions

Use precise valuations to inform your asset management strategies.

FLEET VALUATION

Combine vessel data for total fleet valuation

Build your fleet profile by adding vessels to see a consolidated view of total value and performance.

Unified Fleet Overview

Monitor the collective value of your fleet in one place.

Performance Metrics

Analyze overall fleet performance with aggregated data.

Fix blind spots in your asset planning

Use real-time valuations and vessel-level reports to support accurate buying, selling, and budgeting decisions.

Current Market Data

Adapt key financial inputs to fit your goals and market conditions.

Vessel-Level Details

See each vessel’s profile, including specs, age, and historical value trends.

Your fleet deserves smarter software

Let us show you how Marlo can simplify your operations, save you money, and help you grow.

Sign up

KYC

Frequently Asked Questions

-

How often does Marlo update vessel valuations?

Marlo updates vessel valuations daily, giving you real-time market insights to make confident buying, selling, or holding decisions.

-

Can I see valuation data for chartered vessels too?

Yes — Marlo lets you track the market value of both owned and chartered vessels for a full view of your asset portfolio.

-

What valuation details will I get for each vessel?

You’ll access current market value, estimated new‑build costs, and projected end‑of‑life value, alongside trend insights for smarter decisions.

-

Can I get a consolidated value for my entire fleet?

Yes — Marlo lets you group individual vessels into custom fleets and provides a combined valuation overview at fleet and company levels.

-

How do valuations support my financial planning?

With detailed daily valuations and trend data, Marlo equips you to optimize asset management, improve cash flow forecasting, and guide strategic investments.