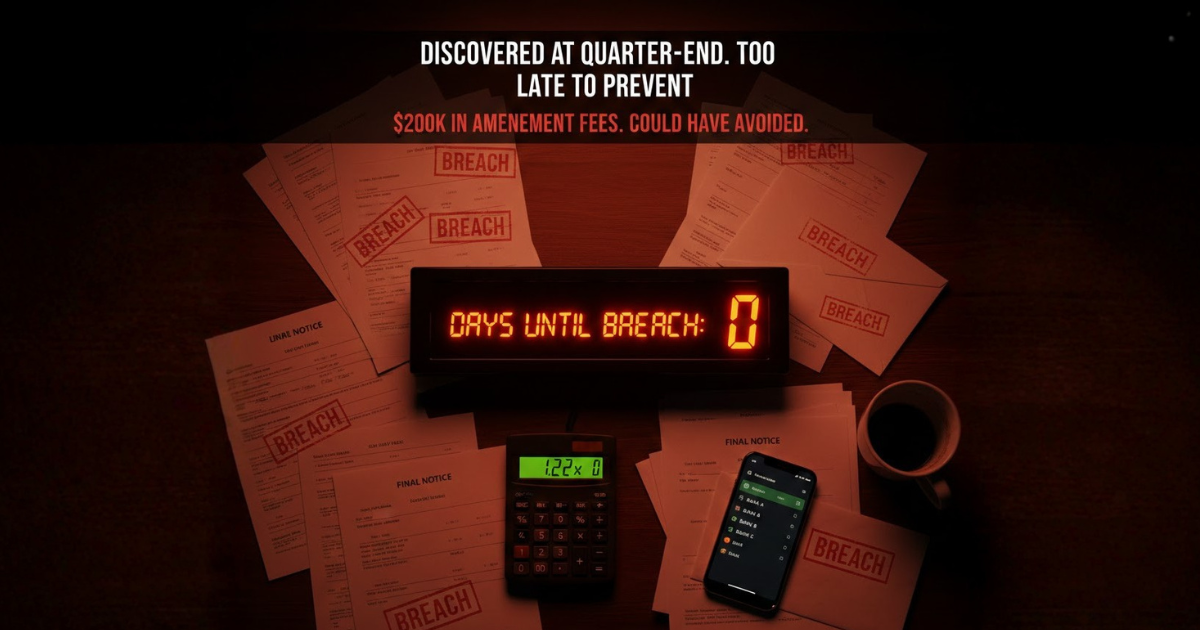

The $200K mistake: How maritime CFOs discover covenant breaches too late

Covenant Breaches Discovered After the Fact It's Thursday morning. Your quarterly covenant compliance certificates are due to lenders by Friday. Your...

Solutions Aligned with Maritime Roles

Model-Specific Business Solutions

Streamlined data insights

Optimized maritime voyage planning

Enhanced financial stability

Maritime-focused business banking

Access legal documents and policies.

Get solutions to all your questions.

In shipping, fuel is more than an operational cost—it is the single largest variable impacting voyage profitability. For most vessels, bunkers account for 40–60% of total voyage costs, and fluctuations in fuel prices can turn a profitable fixture into a financial loss almost overnight.

Yet despite its critical importance, many shipping companies still approach bunker costs in isolation, ignoring the strategic link between fuel price volatility, hedging strategies, and financial performance.

In this article, we explore why bunker management is not just an operational concern, but a strategic financial lever. We’ll examine:

How bunker costs influence P&L and voyage profitability.

The mechanics and benefits of shipping hedging strategies.

How integrated maritime finance systems provide visibility and control over fuel risks.

A typical Capesize or Panamax bulk carrier might burn 30–50 tons of fuel per day, depending on speed, engine efficiency, and cargo weight. Multiply this by a 20–30 day voyage, and fuel consumption easily becomes millions of dollars.

Even small price changes have outsized impacts:

A $50/ton increase in VLSFO can add $500k–$700k to voyage costs for a Capesize.

LNG or alternative fuels may reduce emissions but often carry a premium cost of 10–30%.

Bunker prices are influenced by multiple factors:

Crude oil price swings: Geopolitical tensions, OPEC decisions, or supply chain disruptions.

Regional refinery margins: Bunker prices in Rotterdam vs. Singapore can vary significantly.

Fuel type regulations: IMO 2020 sulfur cap shifted many ships from HFO to VLSFO, creating market distortions.

Exchange rates and taxes: Especially relevant for vessels paying in foreign currencies.

This volatility translates into high financial risk for shipowners and charterers alike.

Traditionally, voyage profitability is calculated as:

Voyage Profit = Freight Revenue – (Bunker + Port Costs + Canal Dues + Other Expenses)

Here, bunker costs are often the largest unpredictable variable.

Consider two identical voyages:

Freight Revenue: $2.5M

Port & Canal Costs: $300k

Bunker Cost Scenario A (stable prices): $1.2M → Profit $1.0M

Bunker Cost Scenario B (price spike $50/ton): $1.7M → Profit $500k

Even a moderate fuel price swing halves profitability, underscoring the need for proactive management.

Bunker costs also impact operational decisions:

Slow steaming reduces fuel consumption but extends voyage duration, potentially lowering freight income.

Route optimization balances fuel efficiency against port schedules and cargo deadlines.

Without integration between chartering, operations, and finance, these decisions are often made in silos, leaving P&L exposed.

Bunker hedging allows shipping companies to lock in fuel prices or mitigate the financial impact of price volatility through derivative contracts. Common instruments include:

Futures and options on fuel indices (e.g., IFO380, VLSFO)

Swaps: Exchange variable fuel costs for a fixed price over a period

Forward contracts with suppliers

The objective: reduce uncertainty in voyage profitability without eliminating operational flexibility.

Stabilised cash flows: Allows predictable budgeting for voyages.

Reduced P&L volatility: Protects against sudden price spikes.

Negotiation leverage: Ability to commit to fixtures without worrying about bunker fluctuations.

Contract duration: Short-term hedges vs. long-term exposure.

Counterparty risk: Choosing reliable financial institutions.

Market timing: Hedging too early or too late can reduce benefits.

Hedging should not exist in isolation. A maritime finance system integrates:

Fuel costs

Hedge contracts

Voyage revenues

Receivables/payables

This integration allows real-time impact analysis of fuel price swings on P&L and cashflow, enabling informed operational decisions.

Finance teams can generate reports showing:

Exposure per vessel or trade lane

Hedge coverage vs. actual consumption

Profit sensitivity to bunker price movements

These insights make the finance department an active participant in operational strategy, not just a reporting function.

Bunker Consumption: 1,000 tons VLSFO

Spot Price Volatility: $500–$600/ton

Freight Revenue: $2.2M

Without Hedging: Spot price spikes to $600 → Fuel cost $600k → Profit $1.3M

With Hedging: Locked at $520 → Fuel cost $520k → Profit $1.68M

Outcome: Hedging preserved $380k of profit, highlighting its strategic importance.

Hard to model hedge impacts across multiple voyages

No real-time linkage to bunker consumption data

Prone to errors, outdated assumptions, and fragmented insights

Integrated platforms (like Marlo SaaS) allow shipping companies to:

Track bunker consumption and prices per voyage in real time

Integrate hedge contracts into the P&L automatically

Model “what-if” scenarios: price spikes, slow steaming, alternative fuels

Forecast cashflow and profitability under multiple hedging strategies

This ensures operational, commercial, and financial teams are aligned in decision-making.

Combine VLSFO, LNG, or biofuels depending on cost and route

Balance emissions compliance (CII, EU ETS) against P&L impact

Buy fuel at strategic ports or timing windows

Hedge selectively to manage peak price exposure

Use voyage analytics to simulate different fuel strategies

Integrate financial outcomes to select the optimal approach

The shipping industry is moving toward data-driven, finance-integrated fuel strategies:

Real-time bunker dashboards showing price, consumption, and hedge coverage

Predictive analytics for fuel market trends

Voyage-linked hedging to protect profitability per fixture

Integrated compliance tracking for carbon and emissions costs

Companies that adopt this approach will not just mitigate risk, but turn fuel management into a competitive advantage.

Bunker volatility is no longer just a cost issue—it directly shapes voyage profitability, cashflow, and financial resilience.

By linking:

Bunker consumption data

Hedging strategies

Integrated finance and voyage analytics

Shipping companies can transform fuel price uncertainty into a strategic tool, optimising P&L, negotiating smarter, and maintaining a competitive advantage.

The takeaway is clear: fuel costs are no longer “beyond control”—they are at the center of maritime financial strategy.

Covenant Breaches Discovered After the Fact It's Thursday morning. Your quarterly covenant compliance certificates are due to lenders by Friday. Your...

Maritime Month-End Close Takes Forever If you're a CFO at a shipping company managing dry bulk or tanker operations, you know this pain intimately:...

For CFOs and operations managers at dry bulk shipping companies, selecting the right software infrastructure represents one of the most consequential...