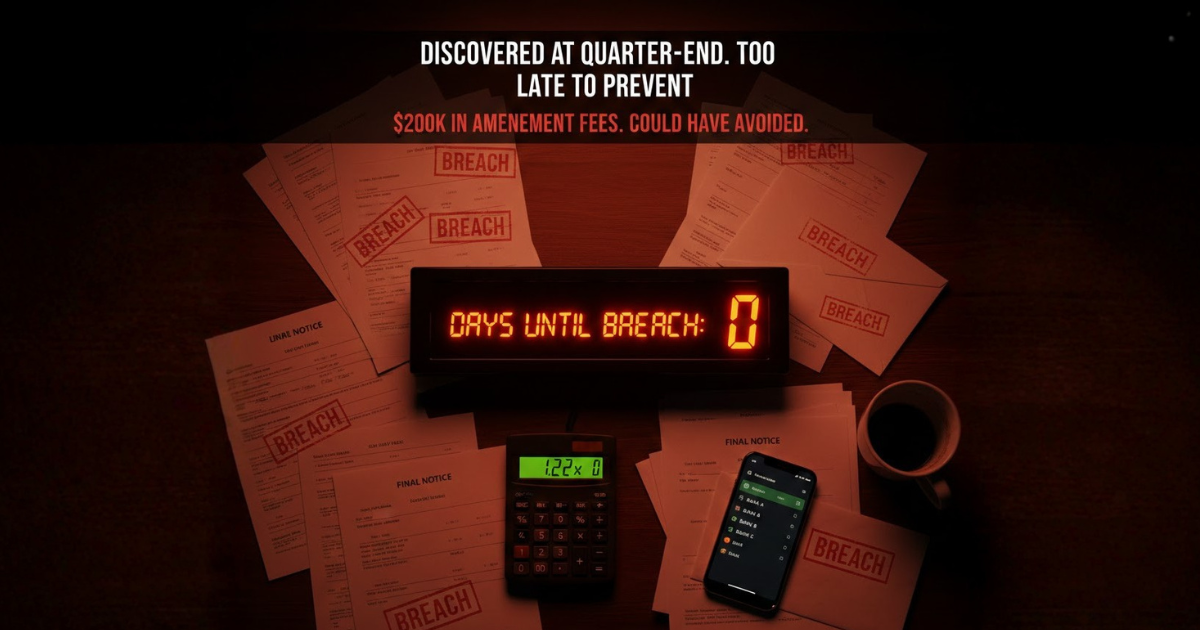

The $200K mistake: How maritime CFOs discover covenant breaches too late

Covenant Breaches Discovered After the Fact It's Thursday morning. Your quarterly covenant compliance certificates are due to lenders by Friday. Your...

Solutions Aligned with Maritime Roles

Model-Specific Business Solutions

Streamlined data insights

Optimized maritime voyage planning

Enhanced financial stability

Maritime-focused business banking

Access legal documents and policies.

Get solutions to all your questions.

4 min read

-1.png) Alex

:

Oct 3, 2025

Alex

:

Oct 3, 2025

For decades, the shipping industry measured profitability with one benchmark: freight earned minus voyage costs. But in 2025, profitability is no longer just about fuel prices, port delays, or charter rates.

Two regulatory forces—IMO’s Carbon Intensity Indicator (CII) and the EU Emissions Trading System (EU ETS)—are fundamentally reshaping how owners, charterers, and operators calculate voyage economics.

These aren’t theoretical policies—they’re financial realities. A vessel with poor CII performance can lose marketability overnight. A European voyage without carbon allowances factored into costs can turn profitable cargo into a loss-making trade.

In this article, we’ll unpack how CII and EU ETS compliance costs directly impact P&L, influence chartering strategies, and change fuel choices across the industry.

Shipping contributes nearly 3% of global CO₂ emissions. Regulators, financiers, and cargo owners are pushing for greener operations—not as optional CSR, but as enforceable rules with direct financial consequences.

IMO’s CII (since 2023): Measures how efficiently a vessel transports cargo per unit of CO₂ emitted. Rated from A (best) to E (worst).

EU ETS (since 2024): Requires ships trading in Europe to buy carbon allowances for CO₂ emissions—phased in at 40% (2024), 70% (2025), and 100% (2026).

The message is clear: profitability is no longer measured in freight rates alone—it’s tied to carbon efficiency.

CII is calculated as:

CII = (CO₂ Emissions / Transport Work)

Where:

CO₂ Emissions = Fuel consumption × Emission factor

Transport Work = Cargo carried × Distance

Each vessel type/size has a required CII score that tightens annually.

A/B-Rated Vessels: More attractive to charterers; potentially earn premium hire rates.

D/E-Rated Vessels: Risk losing charter opportunities or face corrective action plans.

A Panamax bulker rated “E” in 2025 may see 15–20% lower earnings compared to a “B” vessel, simply due to charterer preference.

Slow steaming improves CII but increases voyage duration, reducing annual revenue.

Retrofits (e.g., energy-saving devices) improve ratings but require capex.

Fuel switching to LNG, methanol, or biofuels helps, but adds OPEX complexity.

CII compliance is, in effect, a profitability management tool—not just a technical metric.

The EU ETS covers:

100% of emissions for voyages within the EU.

50% of emissions for voyages entering/leaving EU ports.

Shipping companies must purchase EU Allowances (EUAs), with prices averaging €80–100 per ton of CO₂ in 2024.

Example:

A standard Capesize voyage Brazil → Rotterdam emits ~25,000 tons of CO₂.

At €90 per ton, that amounts to €2.25 million in carbon costs.

By 2026 (with a 100% phase-in), this becomes unavoidable.

For many trades, carbon costs will exceed port dues and rival bunker expenses.

Charterers may shift to eco-tonnage to reduce EUA liabilities.

Owners with non-compliant ships will face lower time-charter rates or longer idle periods.

Banks and investors increasingly link loan covenants to EU ETS compliance.

Carbon pricing is no longer environmental—it’s voyage P&L math.

Traditional voyage P&L includes:

Freight/Hire

Bunkers

Port Charges

Canal Dues

Agency Fees

Now, add two new cost lines:

Carbon Allowances (EU ETS)

CII Compliance Measures (capex/opex)

A voyage once projected at $1.5M profit could drop to $800k after carbon and compliance deductions.

Charterers Prefer Efficient Ships: Cargo owners want to minimize exposure to EU ETS and avoid poor CII ratings.

Contract Clauses Are Changing: “Carbon cost pass-through” clauses are becoming standard in time charters.

Shorter Fixture Durations: Charterers may avoid committing long-term to vessels with uncertain CII trajectories.

VLSFO vs LNG: LNG may reduce emissions by ~20%, cutting EU ETS exposure.

Biofuels: Improve CII scores but cost 1.5–2× conventional fuels.

Future Fuels (methanol, ammonia): Require major retrofits but can deliver compliance advantages.

In practice, fuel decisions are no longer purely about price—they’re strategic levers for P&L.

Let’s compare two voyages on similar routes:

Freight Income: $2.5M

Voyage Costs (fuel, port, canal): $1.7M

Carbon Costs (EU ETS): €1.2M ($1.3M)

Profit: $-500k (loss)

Freight Income: $2.5M

Voyage Costs: $1.9M (LNG premium)

Carbon Costs: €800k ($850k)

Profit: $-250k (small loss, but competitive)

Result: Charterer prefers Voyage B—not because it’s cheaper on day one, but because long-term exposure to carbon costs and CII downgrades makes Voyage A a liability.

Green premium: Efficient ships gain higher resale values.

Brown discount: Older, inefficient vessels may become stranded assets earlier.

Banks (under Poseidon Principles) now assess lending based on CII alignment and carbon exposure. Non-compliant fleets face higher interest rates or restricted access to capital.

Eco-ships command higher hire.

Inefficient ships forced into fringe trades or layups.

Big shippers like IKEA, Amazon, and Shell demand greener supply chains. Owners unable to prove compliance risk losing cargo contracts altogether.

Compliance isn’t just a regulatory exercise—it’s a data and analytics challenge.

CII Monitoring Dashboards

Real-time vessel ratings.

Forecasting impact of operational changes.

Carbon Cost Calculators (EU ETS)

Voyage-linked CO₂ projections.

Allowance purchase planning.

Scenario Modeling

“What if we slow steam by 1 knot?”

“What if we bunker LNG instead of VLSFO?”

Integrated P&L Impact

Combine freight, bunker, port, and carbon costs in one dashboard.

Link to receivables/payables for financial transparency.

Companies that can simulate, forecast, and act on decarbonization costs in real time will not only remain compliant—they’ll secure more cargoes, attract better financing, and protect margins.

Audit Your Fleet: Understand current CII ratings and EU ETS exposure.

Engage Charterers Early: Negotiate carbon clauses and cost-sharing.

Invest in Fuel Flexibility: Explore LNG, biofuels, and retrofits.

Adopt SaaS Platforms: Move beyond spreadsheets—integrate compliance into voyage economics.

Shift Mindset: Treat decarbonization costs as core voyage expenses, not add-ons.

CII and EU ETS aren’t passing trends—they’re structural shifts in how shipping makes money.

The new profitability formula isn’t just freight minus bunkers. It’s:

Freight – (Bunkers + Ports + Carbon + Compliance).

For owners and operators, the choice is clear: adapt P&L models now, or risk obsolescence.

The winners in the decarbonization era will be those who combine efficient ships, smart fuel choices, and data-driven SaaS platforms that put compliance at the center of financial decision-making.

Because in 2025 and beyond, green isn’t just good for the planet—it’s good for the bottom line.

Covenant Breaches Discovered After the Fact It's Thursday morning. Your quarterly covenant compliance certificates are due to lenders by Friday. Your...

Maritime Month-End Close Takes Forever If you're a CFO at a shipping company managing dry bulk or tanker operations, you know this pain intimately:...

For CFOs and operations managers at dry bulk shipping companies, selecting the right software infrastructure represents one of the most consequential...