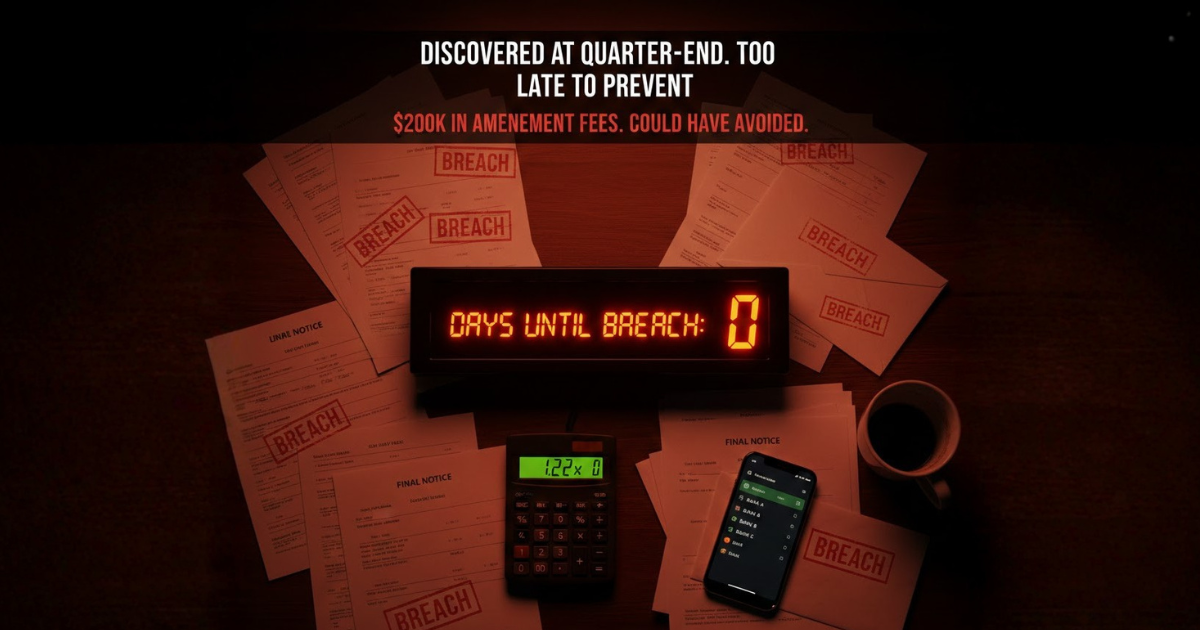

The $200K mistake: How maritime CFOs discover covenant breaches too late

Covenant Breaches Discovered After the Fact It's Thursday morning. Your quarterly covenant compliance certificates are due to lenders by Friday. Your...

Solutions Aligned with Maritime Roles

Model-Specific Business Solutions

Streamlined data insights

Optimized maritime voyage planning

Enhanced financial stability

Maritime-focused business banking

Access legal documents and policies.

Get solutions to all your questions.

3 min read

-1.png) Alex

:

Sep 20, 2025

Alex

:

Sep 20, 2025

Sanctions are no longer a distant geopolitical issue — they directly disrupt voyages, freeze payments, and impact access to credit. Shipping companies and financial institutions increasingly face penalties, reputational loss, and operational setbacks due to weak due diligence. At the same time, evasion tactics have evolved, making manual compliance processes insufficient.

This article explores:

Why sanctions risk matters to shipping and finance.

How modern sanctions evasion works in practice.

Real-world cases where operators and financiers were caught off guard.

The operational blind spots that make companies vulnerable.

A practical digital due diligence checklist.

How platforms like Marlo can lead the shift toward integrated, automated compliance.

Sanctions-hit vessels may be detained, denied port services, or lose access to bunkering. These disruptions cascade into delays, penalties, and cargo seizures.

Banks and insurers block transactions involving high-risk entities. Once a payment is frozen, operators face sudden working-capital stress and strained credit relationships.

Regulators have imposed multimillion-dollar fines on companies facilitating sanctioned cargoes — even unknowingly — as a deterrent for the industry.

Operators associated with weak compliance face higher premiums, loss of coverage, and exclusion from future charters.

Sanctions evasion is increasingly sophisticated. Common methods include:

Ship-to-Ship Transfers (STS): Cargo is moved offshore, often at night, to obscure origin and ownership.

AIS Manipulation: Beyond simply switching off AIS, vessels now spoof or falsify voyage data to appear compliant.

Corporate Layering: Shell companies and complex ownership webs obscure the true beneficial owner.

Document Fraud: Forged bills of lading, invoices, and certificates of origin hide sanctioned cargoes or counterparties.

Iranian Oil Networks

Networks blended sanctioned oil with other origins, used falsified documents, and arranged STS transfers to penetrate legitimate markets — triggering enforcement action.

North Korean Coal Transfers

Operators sanctioned for STS coal trades highlight that even smaller regional firms can trigger cross-border penalties.

Registry Scrutiny

Investigations into flag registries allegedly exploited for evasion have led to global compliance pressure on registries themselves.

Regulators are issuing more frequent advisories aimed at maritime operators and financial institutions.

Industry surveys reveal sanctions as one of the top concerns for CXOs and boards in shipping.

Enforcement cases are climbing, with penalties in the tens of millions, plus long-term reputational consequences.

Siloed Data — Chartering, operations, and finance rarely share risk signals in real time.

Manual KYC — Complex ownership structures and forged documents overwhelm human-only checks.

Payment Monitoring Gaps — Banks often block transactions only after voyages or cargoes are committed.

For effective sanctions risk management, shipping and finance leaders should adopt:

UBO Mapping: Automate discovery of beneficial owners.

Vessel Intelligence: Detect AIS manipulation, STS events, and dark fleet behavior.

Document Verification: Cross-check trade documents with AIS and manifests.

Payment Surveillance: Flag risky beneficiaries and banking routes before payments are sent.

Automated Advisory Ingestion: Track OFAC, UN, and EU sanctions updates.

Explainable Audit Trails: Maintain immutable decision logs for regulators.

Marlo’s unique positioning across Chartering, Operations, and Finance makes it a natural hub for integrated sanctions risk detection:

Cross-Module Risk Scoring: Link voyage, counterparty, and payment data into one score.

Real-Time Alerts & Holds: Block risky voyages or payments until reviewed.

Document Cross-Verification: Flag discrepancies between B/Ls, invoices, and AIS records.

Advisory Integration: Auto-update sanctions lists and tag affected counterparties.

Evidence Packs: Generate compliance-ready summaries for regulators.

Phase 1: Sanctions list ingestion + basic KYB.

Phase 2: AIS analytics + STS detection linked to voyage/payment data.

Phase 3: Automated workflows + evidence pack generation.

Phase 4: Continuous learning from enforcement cases and regulator advisories.

Sanctions and counterparty risk represent a hidden iceberg in maritime finance. Operators who fail to adapt risk not just fines but systemic business disruption. Platforms like Marlo can transform compliance from a reactive burden into a proactive shield — protecting voyages, payments, and creditworthiness in a volatile global market.

U.S. Treasury — Treasury Targets Networks Facilitating Iranian Oil Trade

ICS — Maritime Barometer 2024–2025: Industry Risk Survey

Reuters — Panama Vessel Registry Responds to Sanctions Misuse Allegations (Feb 2025)

UN Panel Reports — North Korea Sanctions Evasion (Coal & Oil Transfers)

C4ADS — Dark Fleet: Sanctions Evasion Tactics in Global Shipping

BIMCO — Sanctions Compliance Guidelines for Shipping

ACAMS — Sanctions Risk & Due Diligence in Maritime Finance

👉 Do you want me to expand this into a polished 2,000+ word draft with smooth narrative transitions (ready for HubSpot upload), or keep it as this structured outline-style blog?

Covenant Breaches Discovered After the Fact It's Thursday morning. Your quarterly covenant compliance certificates are due to lenders by Friday. Your...

Maritime Month-End Close Takes Forever If you're a CFO at a shipping company managing dry bulk or tanker operations, you know this pain intimately:...

For CFOs and operations managers at dry bulk shipping companies, selecting the right software infrastructure represents one of the most consequential...