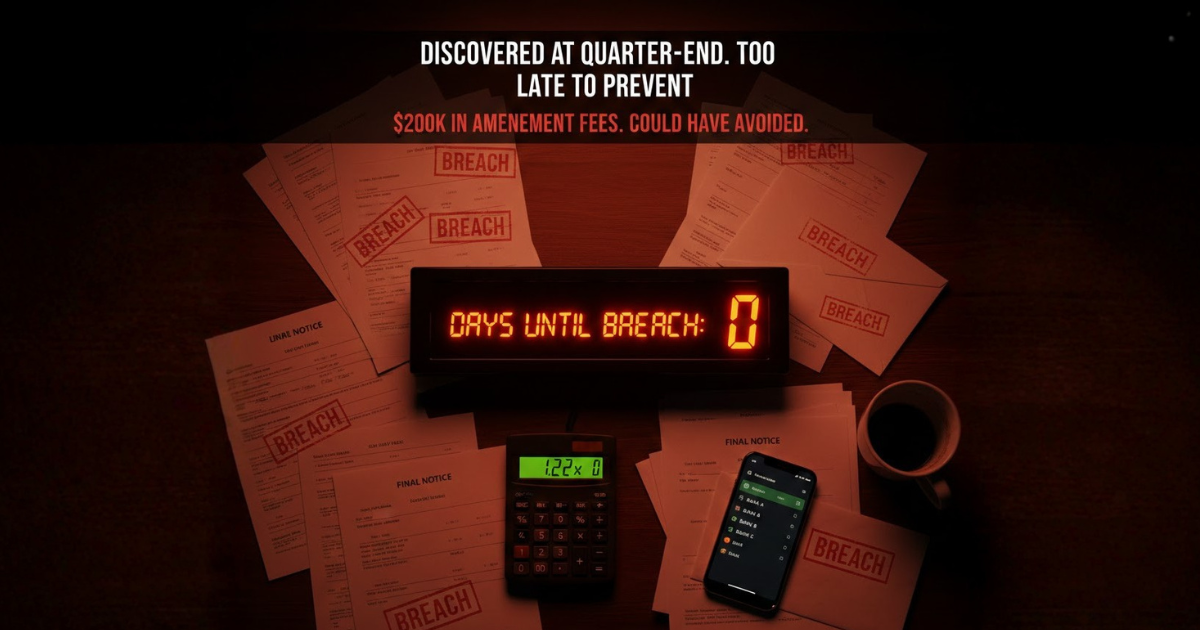

The $200K mistake: How maritime CFOs discover covenant breaches too late

Covenant Breaches Discovered After the Fact It's Thursday morning. Your quarterly covenant compliance certificates are due to lenders by Friday. Your...

Solutions Aligned with Maritime Roles

Model-Specific Business Solutions

Streamlined data insights

Optimized maritime voyage planning

Enhanced financial stability

Maritime-focused business banking

Access legal documents and policies.

Get solutions to all your questions.

In shipping, every fixture, charter, and voyage involves risk. Not just operational or weather risk—but financial and credit risk. A shipowner or charterer’s ability to pay, perform, or deliver can make or break a voyage’s profitability.

Yet, despite its importance, credit risk is often hidden, fragmented, and opaque. Banks, counterparties, and even internal teams struggle to gain a consolidated view of a company’s financial health. In an industry where millions of dollars can change hands in a single voyage, this lack of transparency is a serious vulnerability.

Today, financial visibility and credit transparency are not optional—they are strategic imperatives. Companies that embrace transparency gain trust, negotiate better terms, and mitigate risk.

This article explores the credit score of shipping, why transparency matters, and how tools like Marlo analytics are reshaping maritime finance.

Shipping credit risk is the risk that a counterparty will fail to fulfill its financial obligations. It includes:

Charterers failing to pay freight or hire on time

Brokers defaulting on commissions

Suppliers or agents delaying payments

Financial institutions not honoring letters of credit

Unlike consumer credit, maritime credit risk is high-stakes and multi-layered, often involving multiple jurisdictions, currencies, and regulations.

Key drivers include:

Financial health of the counterparty (balance sheets, cash reserves, debt levels)

Market volatility affecting freight rates and cash flow

Operational performance: delays, off-hire periods, or vessel unavailability

Geopolitical exposure: sanctions, trade restrictions, or regional instability

Even experienced operators sometimes underestimate the impact of these factors on overall voyage profitability.

Without proper credit insight, companies risk:

Overexposure to a single counterparty

Delayed payments and extended DSO (Days Sales Outstanding)

Unexpected write-offs or disputes

Defaults or delayed payments are publicly known in the maritime community. An opaque credit profile can limit access to financing, brokers, and charterers.

Companies that cannot quickly assess counterparty risk may miss profitable fixtures or enter overly conservative contracts, reducing competitive edge.

Similar to personal or corporate credit scores in banking, a shipping credit score quantifies financial reliability. It evaluates:

Payment history

Outstanding liabilities

Market exposure

Compliance and sanction risks

A high score signals financial strength and trustworthiness, while a low score triggers caution in counterparties.

Faster decision-making: Quickly assess counterparty risk before fixture negotiation

Better financing options: Banks and lenders prefer transparent, high-scoring companies

Improved commercial terms: High-scoring companies can negotiate lower deposits or favorable hire rates

Transparency isn’t just about one company—it’s about sharing reliable, verifiable data across brokers, charterers, and banks. Key elements include:

Real-time receivables and payables tracking

Voyage-linked financial performance

Sanctions compliance reporting

Historical payment behavior

When transparency exists, counterparties can trust the numbers, not just the reputation.

Financial visibility improves when credit assessment is integrated with operations:

Delays or off-hire events automatically update risk profiles

Invoices linked to fixtures and voyages improve auditability

Cashflow projections reflect real-time operational performance

This integration reduces blind spots and prevents overexposure.

Platforms like Marlo provide real-time maritime financial intelligence. Features include:

Counterparty credit scoring based on historical and real-time data

Dashboard visualization of receivables, payables, and exposure

Automated alerts for overdue payments or sanction risk

Integration with chartering and voyage management

Quickly identify high-risk counterparties before committing to fixtures

Optimize working capital by prioritizing high-credit-score clients

Enhance negotiation leverage with banks and brokers

Reduce the risk of defaults impacting voyage P&L

Analytics enables scenario analysis:

What happens if a counterparty delays payment by 30 days?

How does exposure to multiple charterers affect fleet cashflow?

What is the aggregate credit risk for the entire company or fleet?

By quantifying these risks, decision-makers move from intuition-based to data-driven maritime finance management.

When companies provide verified credit and operational data, they gain:

Trust from charterers and brokers

Favorable contract terms

Priority in securing cargoes and financing

A transparent credit approach benefits both sides: the counterparty reduces risk, and the company gains a reputation as reliable.

Standardize financial reporting across voyages

Maintain an updated and auditable credit database

Share verified insights selectively with partners

Integrate credit risk management into corporate governance

Transparency isn’t just a compliance exercise—it’s a commercial advantage.

In the next decade, companies that embrace credit visibility and analytics will outperform those that rely on reputation alone:

Credit scores will become benchmarks in chartering decisions

Integrated finance platforms will allow real-time exposure tracking

Banks and insurers will favor partners who provide auditable, transparent data

Shipping is moving from a relationship-driven market to a data-driven market. Companies that leverage analytics to quantify credit risk will gain speed, agility, and financial resilience.

In maritime finance, trust is built on transparency, not assumptions. Credit risk is no longer hidden—it is measurable, analyzable, and manageable.

By integrating:

Operational data (voyages, off-hire, cargo performance)

Financial data (receivables, payables, hedges)

Counterparty analytics (credit scores, historical payments, sanctions risk)

Shipping companies can reduce exposure, improve P&L, and negotiate confidently.

The takeaway is clear: in a volatile and high-stakes industry, transparency is not optional—it is a strategic differentiator. Those who embrace it will lead; those who don’t will struggle to keep pace.

Covenant Breaches Discovered After the Fact It's Thursday morning. Your quarterly covenant compliance certificates are due to lenders by Friday. Your...

Maritime Month-End Close Takes Forever If you're a CFO at a shipping company managing dry bulk or tanker operations, you know this pain intimately:...

For CFOs and operations managers at dry bulk shipping companies, selecting the right software infrastructure represents one of the most consequential...