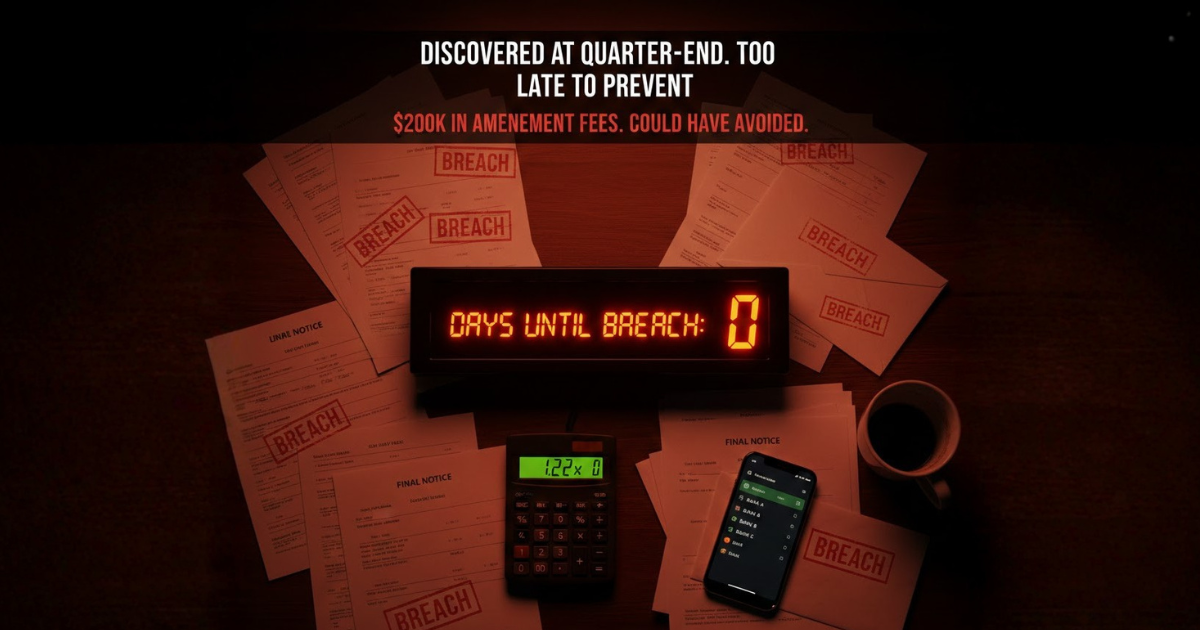

The $200K mistake: How maritime CFOs discover covenant breaches too late

Covenant Breaches Discovered After the Fact It's Thursday morning. Your quarterly covenant compliance certificates are due to lenders by Friday. Your...

Solutions Aligned with Maritime Roles

Model-Specific Business Solutions

Streamlined data insights

Optimized maritime voyage planning

Enhanced financial stability

Maritime-focused business banking

Access legal documents and policies.

Get solutions to all your questions.

The maritime industry stands at a pivotal crossroads in 2026. For CFOs and operations managers at dry bulk shipping companies, understanding emerging maritime technology trends isn't just about staying competitive; it's about survival in an increasingly regulated, data-driven market. As ships generate unprecedented volumes of operational data and regulatory frameworks tighten across Europe and beyond, the companies that master these four key trends will define the industry's next decade.

The traditional approach to fleet management, in which vessel age determines renewal decisions, is becoming obsolete. In 2026, leading operators are adopting a holistic lifecycle optimization strategy that fundamentally changes how they think about assets.

Fleet renewal now depends on a comprehensive assessment of maintenance history, operational performance, and technological modernization potential rather than simply replacing older vessels. A well-maintained 15-year-old vessel with upgraded systems can outperform a newer ship lacking proper upkeep or modern efficiency technologies.

This strategic shift requires CFOs to rethink total cost of ownership calculations. Instead of treating vessels as depreciating assets on a linear path to obsolescence, companies now view them as dynamic technology platforms capable of incremental upgrades that extend useful life and improve performance.

Lifecycle optimization relies heavily on transparent collaboration between owners, operators, and equipment manufacturers. Real operational data from vessel sensors, fuel consumption monitors, and performance management systems enables companies to make informed decisions about:

For mid-sized operators with 5-50 vessels, this approach is particularly valuable. Rather than facing binary decisions about expensive newbuilds or scrapping older tonnage, lifecycle optimization opens a middle path of strategic upgrades that preserve capital while maintaining competitiveness.

From a CFO perspective, lifecycle optimization directly impacts cashflow management. Spreading capital expenditure across incremental upgrades rather than concentrating it in newbuild orders smooths cashflow and reduces financing requirements. It also allows companies to delay major capital commitments while regulatory and fuel technology pathways remain uncertain—a critical advantage in 2026's evolving decarbonization landscape.

Maritime operations generate massive amounts of data every day—from AIS tracking and port calls to fuel consumption and weather conditions. In 2026, the companies extracting actionable intelligence from this data ocean are pulling ahead of competitors still drowning in spreadsheets.

Modern big data analytics in shipping goes far beyond basic vessel tracking. Advanced systems now combine structured data from voyage reports with unstructured information from emails, broker communications, and market chatter. Machine learning algorithms identify patterns that reveal shifting supply-demand dynamics well before they appear in published indices.

For chartering managers, this means moving from reactive to predictive positioning. Instead of responding to market movements after they occur, data-driven operators anticipate freight rate shifts, identify emerging trade routes, and position vessels strategically based on probability-weighted scenarios.

Big data transforms everyday operational decisions:

Route Optimization: Real-time weather routing combined with port congestion data and bunker price differentials enables dynamic voyage planning that reduces fuel costs by 5-15% while improving schedule reliability.

Predictive Maintenance: Sensor data from engines, generators, and auxiliary systems predicts equipment failures before they occur. This shifts maintenance from scheduled intervals to condition-based interventions, reducing off-hire time and preventing costly emergency repairs.

Performance Benchmarking: Fleet-wide data aggregation reveals which vessels, masters, or routes consistently outperform or underperform. This transparency enables targeted improvements and identifies best practices to replicate across the fleet.

The challenge for many operators isn't collecting data—it's integration. Voyage management systems, accounting software, compliance platforms, and communication tools often operate in isolation. In 2026, successful companies are investing in integrated technology stacks that eliminate duplicate data entry, reduce errors, and provide unified visibility across commercial, technical, and financial operations.

For CFOs, this integration delivers real-time visibility into voyage P&L, accurate cashflow forecasting, and the ability to model "what-if" scenarios for strategic decisions. Instead of waiting weeks for post-voyage accounting, financial teams can monitor performance daily and intervene when variances exceed thresholds.

Emerging AI tools in 2026 don't replace human judgment—they enhance it. Natural language interfaces allow managers to query fleet data conversationally: "Show me all Panamax voyages to China last quarter where bunker costs exceeded budget by more than 10%." The system instantly surfaces relevant voyages, identifies common factors, and suggests corrective actions.

These tools are particularly valuable for mid-sized operators who lack the staffing of major shipping lines. A lean team equipped with intelligent analytics can achieve the same operational visibility that previously required dozens of analysts.

While the IMO's Net Zero Framework faced delays in 2025, regional regulations continue accelerating. For shipping companies, decarbonization is no longer a distant 2050 target—it's a 2026 operational reality with immediate financial consequences.

Multiple overlapping regulations create complexity:

EU ETS (Emissions Trading System): After phasing in at 40% in 2024 and 70% in 2025, EU ETS reaches 100% coverage in 2026 for all voyages involving EU ports. This includes not just CO₂ but also methane and nitrous oxide emissions, significantly increasing compliance costs for operators trading in European waters.

FuelEU Maritime: Entering its first full compliance year, FuelEU sets maximum limits on the greenhouse gas intensity of energy used onboard. The 2% reduction target for 2026 is modest, but penalties for non-compliance are substantial—and targets increase to 6% by 2030 and 80% by 2050.

UK ETS: Launching mid-2026, the United Kingdom's independent emissions trading scheme adds another layer for vessels calling British ports, with potential expansion to inbound/outbound voyages from 2028.

For CFOs, these regulations transform from technical compliance issues to material cost centers. EU ETS allowances, trading around €70-80 per tonne in early 2026, add thousands of dollars per voyage to operating costs. FuelEU penalties for exceeding GHG intensity limits can reach millions of euros annually for non-compliant fleets.

With fuel technology pathways still uncertain, the winning strategy is flexibility. Rather than betting everything on a single fuel type, leading operators are:

Investing in retrofit-ready designs: When ordering newbuilds or undertaking major conversions, ensuring vessels can accommodate future fuel systems (LNG, methanol, ammonia) without complete replacement.

Adopting energy efficiency technologies: Wind-assisted propulsion, air lubrication systems, and optimized hull coatings deliver immediate fuel savings and emissions reductions regardless of future fuel choices.

Exploring pooling and compliance banking: FuelEU regulations allow companies with compliance surpluses to pool with or sell credits to operators facing deficits. This creates a financial optimization opportunity separate from physical decarbonization.

Accurate emissions measurement becomes critical for both compliance and commercial positioning. Charterers increasingly demand verified emissions data, and some are paying premiums for lower-carbon voyages. Companies investing in continuous emissions monitoring systems (CEMS) gain advantages:

Decarbonization regulations directly hit working capital. EU ETS requires purchasing allowances in advance of surrendering them for reported emissions, creating a cashflow burden. FuelEU penalties are due by June 30 for the previous year's operations—a significant balance sheet impact for companies exceeding intensity limits.

Sophisticated CFOs are modeling regulatory costs into voyage economics from the fixture negotiation stage. What looked like a profitable voyage before compliance costs might become marginal or unprofitable after EU ETS and FuelEU expenses. This requires updated voyage estimation tools that incorporate regulatory exposure into P&L forecasts.

Maritime regulations in 2026 aren't just more numerous—they're fundamentally different in character, shifting from prescriptive equipment standards to performance-based targets that require continuous monitoring and reporting.

Modern compliance generates unprecedented paperwork:

For operations managers without dedicated compliance teams, this documentation burden consumes significant time that could be spent on commercial activities. The risk of errors or missed deadlines carries substantial financial penalties.

Vessels trading globally face a patchwork of regulations that sometimes conflict or overlap. A single voyage might require compliance with IMO global standards, EU regulations, regional Asian emissions schemes, and flag state requirements, each with different documentation, reporting schedules, and verification processes.

Tracking which regulations apply to which vessels on which voyages requires sophisticated systems. Manual spreadsheet management breaks down as fleets grow beyond a handful of vessels and regulatory requirements multiply.

Leading companies in 2026 are integrating compliance directly into operational workflows rather than treating it as a separate administrative function. When planning a voyage, chartering managers immediately see regulatory cost implications. When a master receives bunkering instructions, the system automatically calculates FuelEU compliance balance impacts. When invoicing charterers, EU ETS surcharges generate automatically based on actual emissions.

This integration requires maritime-specific software that understands both operational realities and regulatory requirements. Generic compliance tools designed for other industries often miss the nuances of voyage-based operations, vessel-specific fuel consumption profiles, and the complex allocation of emissions across different voyage segments.

This is where purpose-built solutions like Marlo's compliance module deliver substantial value. Rather than juggling multiple spreadsheets, disconnected systems, and manual calculations, Marlo provides shipping companies with an integrated platform that:

Centralizes compliance management: Track all regulatory obligations, deadlines, and documentation requirements in one place rather than across email chains and shared drives.

Automates calculations: Generate FuelEU compliance balances, EU ETS exposure, and CII ratings automatically from operational data, eliminating manual errors and reducing time spent on calculations.

Provides real-time visibility: See compliance status across your fleet at any moment, identify potential issues before they become problems, and make informed decisions about pooling, banking, or operational adjustments.

Simplifies reporting: Generate required compliance reports in the correct format for submission to verifiers and regulators, with supporting documentation organized and accessible.

Integrates with operations: Connect compliance data with voyage management and financial systems so that regulatory costs inform commercial decisions in real-time.

For mid-sized operators, this integration is particularly valuable. Instead of hiring additional compliance specialists or overwhelming existing staff with regulatory administration, companies can manage complex requirements efficiently through streamlined software designed specifically for maritime operations.

These four trends, lifecycle optimisation, big data and digitalisation, flexible decarbonization, and evolving regulations, don't exist in isolation. They're converging to create a new operating paradigm for shipping companies.

Lifecycle optimization decisions increasingly depend on regulatory compliance costs and decarbonization flexibility. Big data systems provide the operational transparency required for accurate emissions reporting and compliance verification. Flexible decarbonization strategies require integrated software that can model different scenarios and calculate financial impacts across regulatory regimes.

The shipping companies thriving in this environment share common characteristics: they've moved beyond thinking about vessels as isolated assets and regulations as compliance checkboxes. Instead, they're building integrated technology platforms that provide visibility across operations, finance, and compliance, enabling them to make faster, more informed decisions in an increasingly complex and rapidly changing market.

For CFOs and operations managers at dry bulk shipping companies, the message is clear: maritime technology trends in 2026 aren't optional upgrades to consider "someday." They're immediate competitive necessities that directly impact profitability, cashflow, and market positioning. The companies investing in these capabilities today are building sustainable advantages that will compound over the challenging decade ahead.

The regulatory landscape is evolving faster than ever. Is your company ready for the compliance requirements of 2026 and beyond?

Ready to simplify your compliance management?

See how Marlo's compliance module automates EU ETS tracking,

FuelEU calculations, and regulatory reporting.

Try Marlo for free

Learn how Marlo's integrated compliance and voyage management platform helps shipping companies like yours navigate regulatory complexity while improving operational efficiency and financial visibility.

About Marlo: Marlo provides integrated software solutions for dry bulk shipping companies, combining voyage management, compliance tracking, and financial operations in a single platform designed specifically for the maritime industry. Learn more at www.marlo.co

Covenant Breaches Discovered After the Fact It's Thursday morning. Your quarterly covenant compliance certificates are due to lenders by Friday. Your...

Maritime Month-End Close Takes Forever If you're a CFO at a shipping company managing dry bulk or tanker operations, you know this pain intimately:...

For CFOs and operations managers at dry bulk shipping companies, selecting the right software infrastructure represents one of the most consequential...